A two-speed Europe has always been unacceptable to advocates of the European project. Insistence on a one-speed Europe might, only might, prove to be a feasible political policy. But when it comes to economics, a two-speed Europe is here, and is here to stay for a long while.

Germany is in the midst of an export-led boom that saw its economy grow at an annual rate of over 8% in the second quarter, the fastest pace since reunification in 1990. Profits are good and employers are hiring or adding hours to those working part time. All this to the delight of anti-Keynesian fiscal conservatives. Opponents of further fiscal and monetary stimulus are saying that Germany's rather spectacular performance is due at lest in part to the budget-balancing policies initiated by Chancellor Angela Merkel—no Obama-style borrow-and-spend for Europe's new Iron Lady.

But Germany is not euroland. It is easy to dismiss what we have come to call the periphery countries (Greece, Spain, Ireland, Portugal), but their combined GDP almost equals that of Germany. And they are in trouble. Greece is in recession: its economy contracted at a rate of 6% in the second quarter, while both Spain and Portugal grew at annual rates of less than 1%.

Unfortunately, unlike history, in economics the past is not necessarily prologue. The euro-zone economy is unlikely to repeat its recent performance. Jean Claude Trichet, president of the European Central Bank, expects performance during the rest of the year to be "significantly less dynamic," his forecasters attribute second quarter performance to "temporary effects," and Standard & Poor's says, "Europe's growth most likely peaked at midyear."

For one thing, German exports are unlikely to continue their red-hot growth, especially if the euro remains at approximately current levels. Growth in China, an important market, is slowing, in part because of efforts by the regime to avoid over-heating. America, another important export market, is experiencing a slow-down that has some economists talking "double-dip" and some Federal Reserve Board officials whispering about Japanese-style deflation. Britain has been growing at a decent rate, but reality in the form of the austerity measures the new government is promising to impose has yet to bite.

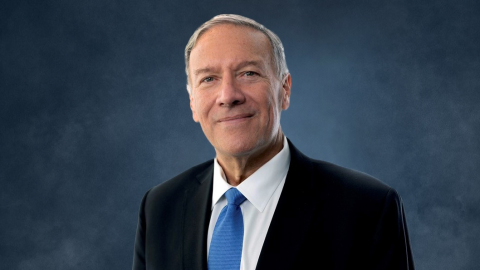

With export growth slowing, an increased burden will be placed on the unwilling shoulders of euro-zone consumers, who are not in a particularly buoyant mood. Kenneth Weinstein, CEO of the Hudson Institute and a colleague who follows French affairs (the economic ones, that is) closely, says that growth in euroland's second-largest economy, which did pick up, remains "too anemic" to create many private-sector jobs. Jacques Dupre of international consultants Symphony IRI, says that "frugal fatigue" might have prompted French shoppers to loosen their purse strings recently, but retail sales will increase only a bit more than 1% in the second half of this year. Indeed, French spending on manufactured goods declined by 1.4% in June, reversing a 0.6% gain in May according to the National Institute of Statistics and Economic Studies, France's keeper of national statistics.

Nor can the periphery countries be expected to snap up many German exports. Greek consumers are not in the market for many Mercedes these days, Spain's recent slight growth is likely to come to an end with the summer tourist season, and the Irish are still digging out of a huge deficit hole. Meanwhile, German consumers must be counted as consumption-shy.

Equally important, the financial problems of the periphery countries and of the euro-zone banks are far from solved. The spread between Greek, Irish and Portuguese IOUs and those of Germany are rising again, and confidence in the ability of euro-zone banks to raise needed capital, temporarily buoyed by initial cursory examinations of the stress tests, is rapidly dissipating. Ireland's government has had to add €10 billion ($12.7 billion) to the €14.3 billion it has already pumped into Anglo Irish Bank Corp, which Standard& Poor's has placed on credit watch. As for Spain, its banking system remains troubled, unable to obtain financing in the market, and therefore forced to borrow a record €130.2 from the European Central Bank in July, the highest amount since the Bank of Spain began keeping records in 1999. Greek, Portuguese and Italian banks also are relying on the ECB to meet their capital needs.

Which leaves Mr. Trichet undecided whether to drive in the fast or slow lanes. Germany, ever fearful of inflation, is encouraging him to continue the exit strategy that has seen excess liquidity drop from €300 billion to €100 billion, and the three-month interbank rate rise by over 20 basis points, according to AllianceBernstein estimates. But Germany's euroland partners have no desire to see Mr. Trichet step on the brakes. They prefer him to keep his foot on the accelerator, and continue supporting troubled banks, even if he must face down a tirade from that ever-present speed cop, Angela Merkel.