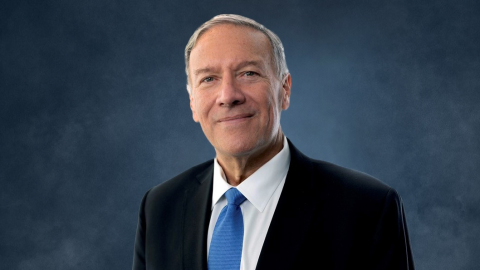

If further proof were needed that a one-size-fits all interest rate cannot suit 17 diverse economies, European Central Bank boss Jean-Claude Trichet provided it by hinting—merely hinting—that he is considering raising interest rates by a mere 0.25%.

Gnashing of teeth in Athens, Lisbon, Madrid and Dublin, where such an impediment to growth adds to the problem of bringing the nations' books into some semblance of order. Tough luck: "The ECB will raise interest rates despite the problems in the peripheral countries," notes chief economist Dr. Jörg Krämer of Commerzbank. Add what appears to be an agreement in Helsinki on Friday to push forward with the "competitiveness pact," which makes reforms such as a constitutional requirement for balanced budgets a precondition of further aid, and there is gloom in the land of the broke.

Smiles in Berlin and Paris. In Berlin because Germans are inflation-phobic, and, their booming economy is unlikely to be derailed by a tweak in interest rates. In Paris because President Nicolas Sarkozy needs a voter-proof Chancellor Angela Merkel to press forward with their plans to harmonize taxes in, and centralize economic management of, the euro zone (sotto voce: in Franco-German hands), a long-held goal of French policy. An inflation-fighting ECB is key to her ability to persuade Germany's voters to spend more hard-earned money bailing out easy-living Greece, Portugal and other Club Med countries that enjoy the lolling effects of what Keats called "a beaker full of the warm South," while Germans shovel snow.

With the ECB's own inflation projection for 2012 at 1.7%, there seems little reason for Mr. Trichet to begin increasing rates. Unless there is more than mere inflation fighting behind his move. Which I suspect there is.

Mr. Trichet knows that the March 24-25 meeting of euro-area finance ministers is more than just another meet, greet, eat and retreat affair. If the ministers fail to rally 'round the Franco-German plan, Mr. Trichet's hope for a Europe "in which national policies are set within agreed limits and are subject to rigorous effective mutual surveillance" will remain unrealized when he steps down in October. His threatened rate rise brings that goal closer to realization.

First, it makes life easier for Ms. Merkel. When Axel Weber dropped out of contention for the top job at the ECB, Ms. Merkel could no longer promise her voters that an anti-inflation, bailout-skeptic would take over from Mr. Trichet. Indeed, it might well be (gasp!) an Italian. Mr. Weber's exit was followed by the devastating defeat in last month's Hamburg elections. And with the finance ministers' meeting coming only two days before elections in Ms. Merkel's Baden-Wüttemberg stronghold, the chancellor wants to reassure her voters that the entire euro experiment has not become a means for profligates to tap into Germany's strong balance sheet. An anti-inflation interest rate rise provides such reassurance.

Second, the prospect of a rate rise makes life more difficult for Portugal. Its prime minister, José Sócrates, says his country does not need and will not seek a bail-out. But his euro-zone colleagues fear that he is being overly optimistic. The longer he waits to ask for the help they know he will need, the larger the eventual bail-out. Worse still, his stalling is making it more expensive for other countries to borrow as nervous investors fear not only a Portuguese bailout, but a sovereign-debt default that won't stop at the Portuguese border.

The eurocracy has reason to worry. New data reported in this paper last week show that Portugal has cash on hand of about €4 billion ($5.5 billion). Next month it must spend more than that to repay one of its long-term bonds, part of the €20 billion it will need this year to repay debt and cover its ongoing deficit, and for which it will have to pay around 7%, an interest rate that most observers agree is unsustainable. In addition, its banks are frozen out of credit markets, and its state-owned companies need to raise €3.8 billion this year. The decision by Rede Ferroviária Nacional, the state-owned railway infrastructure operator, to cancel a €500 million government-guaranteed syndicated bond offer for lack of buyer interest at acceptable rates, is an ominous omen to problems to come.

All in all, not a pretty picture. Euro-zone policy makers favor a prompt bailout to show that they have the debt problem in hand. An ECB hint of a rate increase is one way to force up the already-high rates Portugal must pay in the market, and to increase the pressure on Mr. Sócrates to consider the collateral damage a Portuguese default would unleash on the euro zone as a whole.

A rise in interest rates would also be a handy weapon in the coming negotiations with the new Irish government over the terms of its bailout agreement. Fine Gael leader Enda Kenny has promised to use the close friendship he claims to have with Ms. Merkel to get the interest rate lowered and the repayment date delayed. But if Mr. Trichet engineers a rise in all interest rates, the rate imposed on Ireland by its euro-zone friends seems a bit less extortionate.

Enough of cynicism. Mr. Trichet might believe that rising commodity prices and a growing euro-zone economy justify an increase, and want to re-establish the ECB's slightly tarnished reputation for independence and as an inflation-fighter. After all, when Germany and therefore the euro zone on average needed low rates, he obliged, even though that set off a borrowing binge in countries that desperately needed the cooling effect of higher rates. Not Mr. Trichet's fault that one-size monetary policy rarely fits all.