There is bipartisan agreement on the paramount importance of promoting the United States’ innovation and global leadership in technology markets. Yet some federal agencies and other government entities have deployed a dogmatic interventionist approach that pays little attention to the business realities of real-world technology markets and consequently can undermine innovation. Preserving U.S. technological and geopolitical leadership demands a tailored and fact-based policy approach that reflects informed understandings of the incentive and funding structures that support the innovation and product development pipeline.

The U.S. tech economy’s virtuous cycle of creative destruction—where new technologies displace obsolete ones and promote economic growth—relies on a venture-capital model that fuels innovation by entrepreneurs who disrupt dominant incumbents and technologies. The model is now faltering at both entry and exit. On the entry side, venture capital (VC) investment in the U.S. fell annually by 32% and 33% in 2022 and 2023, respectively, with a 19% decline as of the third quarter of 2024.1 On the exit side, the initial public offering (IPO) and acquisitions market for VC-backed companies has languished, with exits through both channels expected to generate a total value in 2024 last observed in 2016.2 In September 2024, PitchBook observed that “cash back to LPs [limited partners in VCs] is flowing at a rate nearly as low as during the global financial crisis.”3 Given this predicament, it is unsurprising that the total amounts raised by VC funds from investors fell by more than 50% in 2023 and are projected to reach approximately the same level by year-end 2024.4

While credit movements and other business factors play a role in these developments, three government approaches toward intellectual property, antitrust, and securities law impose a hidden tax on VC-backed innovation—a signature feature of the U.S. tech economy. These approaches reduce investors’ confidence in securing returns on startup investments through IPOs or acquisitions, which can then discourage investment and slow down the creative destruction cycle. Contrary to the prevailing policy trajectory, reinvigorating the U.S. innovation economy requires both stronger enforcement of intellectual property rights and more tailored application of the antitrust and securities laws.

Specifically, this policy memo sets forth three “policy resets” in intellectual property, antitrust, and securities law that would likely reinvigorate U.S. innovation leadership:

- Restoring a robust baseline of IP protection and, in particular, reinstating the historical presumption of injunctive relief in the case of adjudicated cases of infringement.

- Restoring an empirically grounded approach to antitrust enforcement anchored in the consumer welfare standard and, in particular, predicating merger challenges on a showing of likely harm to competition, rather than merely conjectural risks.

- Re-anchoring securities-law enforcement in protecting the integrity of the capital markets and rejecting overly broad understandings of materiality that encompass unrelated policy goals.

Eroding Patent Protections

As I show in a new book,5 the Supreme Court, Congress, and federal antitrust regulators have repeatedly taken actions since the early 2000s to undermine the strength of patent protections. Most notably, in a wide range of industries, there is now little expectation that a patent owner can secure injunctive relief against even adjudicated infringers. This is a legacy of lower courts’ increasingly expansive interpretation of the Supreme Court’s 2006 decision to place limits on injunctive relief in eBay Inc. v. MercExchange LLC.6

This form of judicial fiat has resulted in a compulsory licensing regime that favors infringers over inventors and unproductively shifts the pricing of intellectual property (IP) assets from the marketplace to the courtroom. While it is often claimed that the substitution of monetary damages for injunctive relief still makes innovators whole, this overlooks the practicalities of real-world litigation. When smaller innovators must litigate against tech platforms with resources to sustain protracted proceedings over many years and in multiple venues, the patent system ceases to provide a reliable mechanism to translate idea capital into financial capital. As I have shown in prior research,7 it is telling that the largest tech platforms have been among the most consistent advocates for weaker patent protections.

Insecure property rights in turn discourage the investors on which emerging firms rely to fund the testing and product development process. These disincentive effects are most pronounced in biopharmaceuticals and semiconductors, where startups widely rely on patent protection to earn a return on investment in research and development. When courts tend to favor imitators over innovators in patent infringement litigation, risk capital migrates away from biotech and chip design to other industries that offer a higher economic return but do not make comparable contributions to public health or national security. The still-pending RESTORE Patent Rights Act of 20248 (which enjoys bipartisan sponsorship) would counteract these effects by re-establishing a rebuttable presumption that a patent owner is entitled to a permanent injunction once a court has upheld validity and found infringement. 9

Antitrust Overreach

Antitrust authorities have adopted the largely conjectural view that tech platforms regularly engage in so-called killer acquisitions to suppress potential competitors. This academic model of antitrust risk can have anticompetitive effects if implemented in real-world markets.

As I show in a recent publication,10 the theory has only been demonstrated in a small segment of the pharmaceutical mergers and acquisitions universe and lacks compelling factual support in information technology markets. Rather, platform/startup acquisitions are typically an efficient combination of the inventive capacities of a startup and the capital-intensive production and distribution capacities of a larger firm. In an effort by the Federal Trade Commission in 2022 to challenge Meta’s acquisition of a small virtual-reality fitness app (a market in which entry barriers would appear to be trivial), the agency could not even survive summary judgment.11

Notwithstanding this loss in court, the agency’s demonstrated willingness to intervene based on “nascent” competitive harms (as indicated in the recently revised Merger Guidelines12) can generate transaction costs that deter acquisitions that would deliver value for startup founders, investors, and employees. A likely example is the threat of antitrust action that led Amazon to withdraw in January 2024 from acquiring iRobot (the maker of the Roomba autonomous cleaning device). iRobot promptly laid off over one-third of its workforce,13 and its stock price has declined by approximately 75% through December 11, 2024.14 This is a clear case of value and job destruction that can arise when antitrust regulators exhibit little concern over making false-positive interventions.

The elevated risk of merger challenges can have a domino effect that raises entry barriers to small firms in tech markets. Given that about 90% of VC-backed exits occur by acquisition,15 the threat of a regulatory challenge in the case of transactions that pose no demonstrable risk to competition can impede startups’ ability to raise capital in the first place. Those distortions have recently been compounded by extensive additional disclosure requirements imposed by the antitrust agencies16 concerning acquisitions that fall under the Hart-Scott-Rodino Act. Contrary to long-standing merger review practice, these new requirements now require all reported transactions to bear much of the costs that had been appropriately allocated only to the small minority of transactions that raise meaningful risks of anticompetitive harm.

Securities and Exchange Commission Overreach

Securities regulations and litigation have increased the costs of going and staying public beyond the point of economic rationality for many firms and, in particular, smaller firms for which compliance costs are most burdensome.

In the 1980s, about 90% of successful VC-backed startups exited through an IPO;17 as noted, that number has now fallen to about 10%. While the decline of the IPO partly reflects the growth of private capital markets, it also reflects the compliance burden and litigation exposure faced by public companies from regulators and the class-action bar. In 2023, public companies paid out $4.4 billion to settle private securities class actions, the highest amount in 10 years.18 These figures do not include the significant costs borne by public companies from shareholder class-action and derivative suits in state courts.19 While some suits may be justified, these compliance and litigation costs fall most heavily on smaller firms and, everything else being equal, make the public capital markets a less attractive exit avenue as compared to being acquired by another company.

Current Securities and Exchange Commission (SEC) leadership has compounded these effects by adopting extensive climate-related disclosure requirements20 (currently being challenged in court) that may have laudable intentions but reflect an expansive understanding of materiality21 that encompasses policy objectives beyond the agency’s statutory mission to protect the integrity of the capital markets. While sound regulation is a necessary component of well-functioning capital markets, administrative overreach encourages emerging companies to avoid the public markets and “cash out” by selling to an incumbent. That shrinks the capital markets the SEC is designed to preserve and counterproductively deters founders from staying independent and securing financing from public investors. In short, there is a reasonable case to be made that expansive securities regulation, combined with securities and shareholders litigation, is responsible in part for the substantial decline of the public markets as a financing vehicle for the innovation economy.

High Stakes

Policies that impede both entry and exit avenues for existing startups discourage investment in future startups since investors do not foresee a viable exit option even in the minority of cases in which a startup achieves technical and commercial success. This not only punishes founders, employees, and investors but also upsets the symbiosis between emerging firms that tend to excel in developing innovations and platforms that tend to excel in deploying innovations rapidly and efficiently.

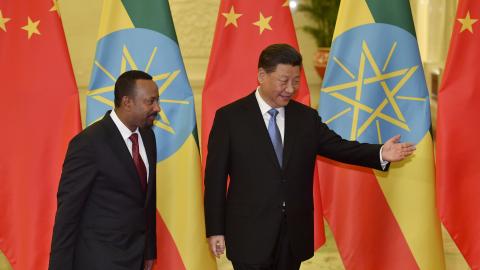

This blunt approach to innovation policy can also have adverse national-security consequences that extend beyond solely economic considerations. In the race for geopolitical leadership in the face of a China-led autocratic coalition, the U.S. enjoys an unequaled “IP trade surplus” with the rest of the world.22 To preserve that advantage, the current administration has tended to focus on top-down industrial policy that relies on grants and subsidies. While public investment in infrastructure is critical in certain strategic industries and may be justified to restore domestic semiconductor production capacities, U.S. tech excellence has historically emerged through a largely uncoordinated bottom-up process of private investment.

This is not accidental. As I demonstrate in a recent publication,23 innovation thrives under the freedom of thought and enterprise that characterizes market-driven liberal democracies. Given the high economic and geopolitical stakes involved in innovation policy, it is vital that policymakers in the next administration reassess current approaches to intellectual property, antitrust, and securities law that pose significant risks to U.S. technological leadership.