At three different points in President Obama's recent speech at the Charlotte convention, he cited the economic challenges that China poses to the United States. In other speeches, he has alluded to what he seems to regard as a U.S.-China race to promote the use of "green" energy sources. Indeed, to win that race, the administration is spending large sums of taxpayer money and imposing strict mandates designed to push green technologies that cannot pass the market test. The China threat also serves as a big part of the president's rationale for protecting weak U.S. firms from foreign competition and for his schemes to reshape the U.S. auto sector.

Like the president, many Americans are clearly impressed with the results that Beijing's economic policies have achieved. Today, 43 percent of Americans name China as the world's leading economic power; only 38 percent name the United States. Europeans pick China by even larger margins. Doubtless many of these people would applaud President Obama's green energy programs as an effort to take a page out of Beijing's playbook.

The truth is, though, the notion that China is the world's leading economy is preposterous. To the contrary, China remains a poor country. According to the CIA's World Factbook, in 2011, China's per capita Gross Domestic Product (GDP) was only 17 percent as large as that of the United States. Perhaps more tellingly, it was only 57 percent of Mexico's.

China's glowing image, then, does not stem from its current status; rather, it arises from the projecting its current growth trends well into the future. It is certainly true that China has been growing robustly. Between 1990 and 2008, China's real dollar GDP per head grew at a rate of 7.11 percent per year. Then again, at a comparable stage in their development, Japan, South Korea, and Taiwan had growth records much like that of today's China.

Indeed, other countries have had growth surges, only to then regress. The Soviet Union grew rapidly from the 1950s through the 1970s. By 1991, it had collapsed. In the late nineteenth century, Argentina had become one of the world's richest countries. Then its growth stalled. Brazil did much the same in the twentieth century. It seems clear, then, that a growth surge, even a strong one, does not always presage future success.

There is some reason to suspect that China could follow a similar path. The forces that have so far propelled China's rise are fading. It's once vast pool of cheap surplus rural labor is close to being exhausted. The size of the total labor force will begin shrinking as early as 2015, and wages are already rising. Also, the effects of earlier reforms, and those of the first round of technology imports, have been largely absorbed.

Then too, China's past growth has also relied on strong exports to the United States and Europe. These economies are now struggling with aging populations and the burden of fiscal over-indulgence. China's growth rates are beginning to flag as its exports weaken.

Beijing's has been slow to adjust its policies to these new realities. Instead, it has continued to pump resources into infrastructure construction and heavy industry. Its policies are greatly biased in favor of the large state owned enterprises (SOEs). Beijing manipulates capital markets and tax policy to lower the SOEs' cost of capital. Moreover, it bars private sector firms from competing with SOEs in many key markets. By lowering capital costs and blocking competition, these policies work in much the same way as the Obama administration's green energy tax subsidies, loan guarantees, and mandates.

But far from speeding China's economic growth, Beijing's tilt in favor of the SOEs actually slows it. A 2005 survey of 12,400 Chinese firms in 120 cities found that private firms' average rates of return were 50 percentage points higher than those of wholly state-owned firms. Another study made similar findings and also concluded that the SOEs were also less innovative than the private sector firms. In fact, China's SOEs seem to perform little better than do President Obama's much-cosseted U.S. green energy firms.

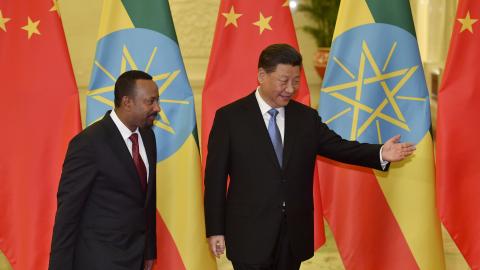

In China, Xi Jinping, the heir apparent as General Secretary of the Communist Party, is reputed to favor private enterprise. He may even be willing to do so at the expense of the SOEs. Given that the private sector's expansion has been the main driver of China's growth, this policy would make economic sense.

Meanwhile, just as Beijing may be considering taking another stride toward a more market-based economy, President Obama wants to move the United States toward a more state-directed one. He does so, moreover, in the name of competing with China. It is one thing for ordinary citizens to make faulty policy judgments based on projecting a past growth trend too boldly into the future. Surely, a president should know better.