The Iranian regime has never looked so weak and vulnerable, with its empire of terror in tatters (thanks to Israel) and mounting crises at home (thanks to its corruption). Amid the doom and gloom, Iranian elites have at least been able to count on the continued flow of oil revenues needed to line their own pockets, repress the Iranian people, and pursue nuclear weapons.

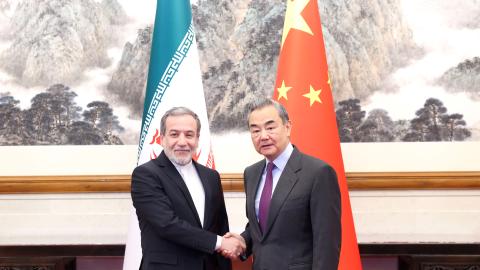

For this, they must thank China, which has thrown Iran an economic lifeline in recent years by purchasing nearly all of its oil exports. But credit is also owed to the Biden administration, whose refusal to enforce sanctions has allowed the partnership between Beijing and Tehran to flourish.

It is hard to overstate the Iranian regime’s reliance on the oil industry, which accounts for roughly one-quarter of Iran’s GDP. As in most sectors of Iran’s kleptocratic economy, the main beneficiary is the Islamic Revolutionary Guard Corps, which now controls at least 50 percent of oil-production operations.

Less widely understood is how quickly, and completely, Iran has become an economic vassal of China. As recently as 2018, China accounted for roughly one-quarter of Iran’s crude oil exports. But it is now the ultimate destination for almost every shipment.

Contrary to popular belief in conservative circles, the Biden administration has generally not stripped away sanctions on Iran or issued significant exemptions to them. The exception to this was the waiver of restrictions on $16 billion in energy payments to Iran from South Korea and Iraq.

Instead, the Biden team quietly neglected to enforce sanctions, providing Tehran with the breathing space it needed to develop its relationship with China. Biden officials have consistently denied this, but the data tell a different story. According to official U.S. government estimates, Iran’s crude oil exports plummeted from 2 million to 400,000 barrels per day under President Trump, but have since rebounded to 1.5 million per day under Biden.

Trump has promised a return to the “maximum pressure” sanctions that caused Iran’s oil exports to collapse, threatening the survival of the regime itself. The numbers make clear that, to do so, he will also need to impose significant costs on China.

The good news for Trump is that, on paper at least, Iran is still subject to the most robust U.S. sanctions program of any country alongside North Korea. This means that — to snap back to maximum pressure — all he needs to do is revoke the waivers and make clear to banks and other businesses that, whatever the previous administration may have said behind closed doors, transactions with Iran are once again off-limits.

Trump will then need to neutralize the “shadow fleet” of tankers on which Iran relies to transport its oil exports to China. This will require going further than sanctioning and seizing the vessels themselves. The Biden administration tried this and found itself (perhaps intentionally) in an unwinnable game of Whac-A-Mole. To cripple the system — the ports, insurance brokers, flag states, and other actors — that enables their illicit trade requires a comprehensive strategy.

To show that he means business, Trump could impose what are known as “secondary sanctions” on a minor Chinese bank that has facilitated illicit payments for Iran. While President Obama (of all people) sanctioned China’s Kunlun Bank for supporting Iran as far back as 2012, and President Trump targeted Bank of Dandong for helping North Korea in 2018, the Biden team has not followed suit for fear of upsetting Beijing. We know that even the threat of sanctions works against Chinese banks, which increasingly refuse to deal with Russian counterparts for fear of triggering backlash from the U.S.

While China is now Iran’s critical economic partner, that dependency is far from reciprocal. China receives some 15 percent of its oil from Iran and has other options. Faced with sufficient U.S. pressure and the prospect of a doomed regime in Tehran, Beijing may well conclude that it’s not worth the risks and ditch its junior partner in crime. Iran can scrabble around for alternative buyers, but none will match the scale of China’s demand.

Sanctions are only one part of Trump’s maximum-pressure doctrine. But the collapse of Iran’s oil revenues from China would dump an economic disaster on top of the political crisis and security meltdown already wrought by Israel’s advances.

The writing will then be on the wall for Iran’s regional ambitions and perhaps even for the regime itself — and with its collapse, a major player in China’s malign global game would be undone.