On January 8, the Peterson Institute for International Economics here in Washington D.C. launched a new study by Trevor Houser and Shashank Mohan on the oil and gas production boom in the United States.1 Houser and Mohan use a general equilibrium model to assess the effects on the rest of the U.S. economy and, since the U.S. economy is so large, find the impact to be significant but not overwhelming: between 2010 and 2020 the total impact of oil and gas production growth is estimated at 2.1 per cent of U.S. GDP, roughly the boost provided by the Recovery Act stimulus spending in 2008-2012, but spread over a longer period. Still, in the case of oil, increased U.S. production was enough to offset production declines in Europe and supply reductions due to sanctions on Iran.

Houser and Mohan observe that natural gas exploration and development in the United States was the work of dozens of small, independent firms; shale gas development was the work of a handful of larger firms with ties to major conventional producers (a development pattern similar to that of Canadian oil sands). For natural gas, supply came to the market from several uncoordinated places at once, flooded the market, and prices fell – along with U.S. imports from Canada.

Departing from Houser and Mohan, my own takeaway from their analysis is that the abundant supply conditions in the North American natural gas markets are a distinctive feature and also an enduring one thanks to the structure of production.

In a market with abundant supply of natural gas, it makes sense to think about how to generate corresponding abundant demand in order for the market clearing price for gas to rise to a more profitable and sustainable level, while also remaining affordable for customers.

Public policy can help. But how?

Technology Innovation

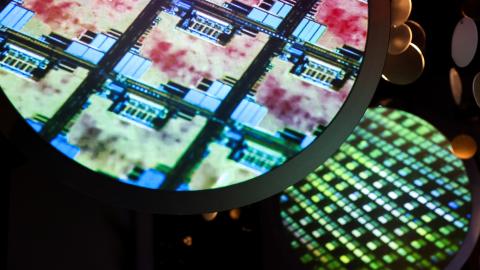

Today’s abundant supplies of shale oil and natural gas began with technological innovation: the combination of hydraulic fracturing and directional drilling. The private sector has been innovating on energy use as well. General Electric’s 7F 5 Series gas turbines now achieve better than 59 per cent efficiency in combined cycle operation, and Siemens H Class gas turbines have set a record with 60.75 per cent efficiency – making the increased use of natural gas in electricity generation more attractive. Public utility investments in smart grids in many parts of Canada and the United States create new opportunities for heavy and even light industrial consumers to invest in electrical cogeneration capacity using super-efficient gas turbines to both lower energy costs and improve reliability.

There are also promising developments in hydrogen fuel cell technology that would allow commercial and residential consumers to utilize hydrogen extracted from natural gas to store and generate electricity efficiently. The same smart grid investments that permit cogeneration could empower hydrogen fuel cell equipped buildings to sell power to the grid during off-peak periods, a realization of the distributed electrical grid that alternative energy proponents as well as energy reliability planners have talked about in the wake of natural disasters such as Hurricane Sandy and Hurricane Katrina.

Public policy can do a lot to promote investments in cogeneration and hydrogen fuel cells through tax incentives and capital equipment amortization. The public will benefit from such encouragement as the electrical grid becomes stronger and more reliable.

Transportation

The U.S. Energy Information Administration (EIA) estimates that U.S. energy consumption by the transportation sector will remain steady at roughly one quarter of all energy usage through the year 2040.2 Most of that will be in the form of petroleum-derived fuels, from gasoline to diesel to jet fuel.

The promise of electric vehicles still shines brightly, but the EIA notes that without a breakthrough in vehicle battery technology, this is a distant scenario. The past several years saw an extraordinary U.S. experiment with biofuels – alcohol blended fuels such as ethanol and methanol derives from biomass, primarily corn—that came to be seen as an expensive and market-distorting disappointment, with Congress cutting ethanol subsidies and the U.S. Environmental Protection Agency forced to withdraw cellulosic ethanol mandates for refiners.

Yet both ethanol and methanol can be generated from natural gas. Celanese Corporation has a commercial scale facility producing ethanol and methanol from natural gas in Texas, and the Coskata Energy plant in Illinois will use natural gas feedstock for ethanol production in 2014. Natural gas derived ethanol could be used to meet the E10 blend requirements for gasoline (to boost octane and lower particulate vehicle emissions) initially, but the technology for “flex fuel” vehicles that can use higher percentages of ethanol (up to 85 per cent) or methanol (up to 60 per cent) blended with gasoline is on the road today in vehicles produced by General Motors.

However, governments must adopt fuel efficiency standards for vehicle manufacturers that support flexible fuel, and in the interest of reducing petroleum dependence, accept ethanol and methanol derived from natural gas as a substitute for biomass.

Resilience – continental and global

Governments at the federal and state/provincial levels can do more to improve the resilience of our energy market by planning and permitting new infrastructure by the private sector. A certain amount of spare capacity and interconnectivity would allow mutual aid in a crisis – and the credentials of the skilled professionals who can restore gas and electrical service to customers after a disruption ought to be mutually recognized so that affected jurisdictions can rely of neighbors for “surge” capacity in a crisis.

As continental energy markets improve their resilience, the next frontier will be energy export. By permitting LNG export terminals, both Canada and the United States will help allies around the world to address their energy needs with North American gas. Large gas export volumes will gradually help to establish something approximating a global price for natural gas as arbitrage lowers prices in Asia and Europe (and as Europe benefits from reduced dependence on Russian supply).

A global natural gas market will not be immune to up and down changes in the commodity price, but it will be more stable and predictable for consumers and suppliers. And that reliability and resilience could draw more customers to trust natural gas, creating the abundant demand to balance newly abundant North American supplies.