The bipartisan Corporate Transparency Act (CTA), passed in 2021 during the first Trump administration, mandated the creation of the Beneficial Ownership Information Register (BOIR). The act requires companies to disclose their true owners to the United States Treasury Department to counter widespread misuse of anonymously owned, US-registered shell companies for money laundering and sanctions evasion.

Implementing the BOIR will be vital for advancing the Trump administration’s top law enforcement and national security priorities. In particular, it will help disrupt Mexican cartels’ illicit financial networks and dent the profits of the individuals and organizations that fuel the fentanyl and human trafficking crises.

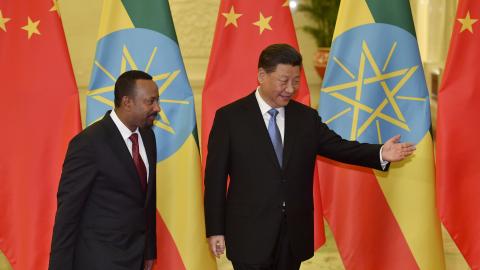

Cracking down on shell companies has become increasingly challenging in recent years as the cartels have partnered with Chinese money laundering organizations. With access to China’s vast, opaque financial system and tacit backing from the Chinese Communist Party, these shadowy networks have transformed money laundering methodologies and supercharged the cartels’ profits. US law enforcement agencies need to have every reasonable tool at their disposal to keep up.

The BOIR could prove especially useful for enforcing the Trump administration’s planned tariffs. There are already examples of American businesses using shell companies to evade duties. Such cases will surge if the Trump administration introduces tariffs on the scale the president and his officials have discussed.

Current Status

Unfortunately, legal challenges over the constitutionality of the CTA have suspended Treasury’s implementation of the BOIR. The resulting procedural limbo has confused millions of small business owners. But the registration process will be quick, straightforward, and nonintrusive for most firms.

Additionally, efforts in Congress like the Repealing Big Brother Overreach Act seek to scrap the CTA and deprive the Trump administration of this important tool. This campaign has gathered steam for two reasons.

First, many small business owners are only now hearing about the CTA and are understandably wary of what appears to be more red tape from Washington. But this is the only time most businesses will have to worry about the act, as companies do not need to update their registrations unless there are changes to ownership.

Second, the BOIR is politically vulnerable because it is not yet justifying its existence by contributing to criminal investigations. It may take months or even years before the registry’s transformative role is fully apparent and widely accepted.

Unfortunately, the regular workings of the BOIR will not lend themselves to headlines, whereas the arguments against it often do. Below are five popular misconceptions the act’s opponents push.

Myth 1: Beneficial ownership information registers do not work.

It goes without saying that criminals will commit identity fraud, submit false information, or skip the BOIR form entirely. But countries with registries like the BOIR have found that asking honest small business owners to submit their beneficial ownership data is useful for criminal investigations.

A United Kingdom government survey found that law enforcement agencies access the People with Significant Control register, London’s equivalent of the BOIR, on a weekly basis. This is because the absence of a filing or the filing of inaccurate or irregular information can be valuable clues in a criminal investigation.

Meanwhile, US officials already use beneficial ownership information about foreign shell companies that other countries provided through BOIR equivalents. This makes it even more absurd that US law enforcement cannot see who is using American shell companies to transfer funds across—and within—US borders.

Myth 2: The CTA unduly burdens small businesses.

The last thing that America’s overburdened small businesses need is more red tape from Washington. But the BOIR form takes most owners about 10 minutes. It only requires a name, an address, a government identification number, and a picture of the corresponding physical ID.

Most owners can then file and forget it because, as noted above, the registry does not require businesses to refile unless ownership changes. There is no fee, and most businesses will not need to involve lawyers or other professionals.

More than two-thirds of owners who have already registered found it “easy,” according to a recent poll.

Cutting red tape and unleashing prosperity are rightly top priorities for the Trump administration and 119th Congress. But policymakers could target thousands of other regulations that impose heavier burdens instead of gutting important national security measures like the CTA.

Myth 3: The CTA unfairly targets small businesses.

Larger businesses are excluded from the CTA for two reasons.

First, their ownership structures are usually accessible to law enforcement through the Securities and Exchange Commission or other filings.

Second, larger businesses do not share the obvious characteristics of shell companies, which generally list very few employees. Law enforcement can easily identify and contact owners or employees if necessary. Unfortunately, small businesses are harder to distinguish from shell companies because they have fewer employees and may be more difficult to contact.

By filing, small business owners effectively rule themselves out of suspicion so that law enforcement can move on to the next line of inquiry without bothering them. Additionally, in cases where criminals have stolen the identity of a legitimate business, the BOIR can help law enforcement identify the real owner and take appropriate action.

Myth 4: The CTA is intrusive and dangerous.

Data protection, privacy, and the potential for government abuse are legitimate questions about the CTA. But legislators sought to minimize these risks while meeting law enforcement and national security imperatives.

The BOIR is a secure, non-public database housed at the US Treasury Department. Treasury officials can grant access to BOIR data in response to requests from other federal officials engaged in national security, intelligence, or law enforcement activity, or to local law enforcement agencies who have obtained a court order. But the requesting party will need to justify the request to demonstrate that it is not a so-called fishing expedition. Improper access would be digitally documented, easily traceable through the system, and punishable by up to 10 years in prison.

Additionally, US banks will be allowed to check the BOIR to speed up the due diligence process when onboarding consenting customers. In this application, the act may reduce red tape for new small businesses.

Of course, there is always the risk of a leak or a hack by hostile actors. But the perpetrator would not gain access to citizens’ private finances or vital information, as some critics seem to suggest. Additionally, federal and local governments already hold the kind of information the BOIR requests in various less secure places. And private companies routinely harvest, misuse, or lose data that is far more sensitive.

Myth 5: Honest business owners will be jailed for forgetting to file.

The CTA stipulates a civil penalty of $500 for each day that a company remains in violation and criminal penalties of up to $250,000 and five years’ imprisonment.

This may seem punitive, but there are crucial caveats. As noted above, agencies can only access BOIR data to support ongoing national security, intelligence, or law enforcement investigations. This means that law enforcement will only notice noncompliance if it is interested in a company for other, more serious reasons.

Failure to file must also be “willful” to beget criminal penalties. This is one of the highest forms of criminal intent under US federal law. Those who simply forget to file, or are unaware that they need to do so, cannot therefore be prosecuted.