View PDF with photos and figures.

Introduction: Deregulating the Defense Industry

The AUKUS agreement (among Australia, the United Kingdom, and the United States) may be one of the most significant defense industrial initiatives in the post–Cold War history. The agreement’s main part, Pillar I, has created a path for Australia to acquire nuclear-powered and conventionally armed Virginia-class fast attack submarines. The first submarine will be delivered in 2032, and two more will be sent in 2035–37. Then local Australian production of nuclear submarines will deliver five more.

Pillar II of the agreement has forced Washington to liberalize the regulatory regime that constrains the defense trade, enabling key players in those countries to operate under a similar regulatory regime. The Department of State also announced this month a regulatory change that will further reduce the export licensing restrictions for defense trade within AUKUS. Additionally, the April 2024 US-Japan summit significantly increased Japan’s access to advanced technology.

This trend toward deregulation among US allies in the Indo-Pacific is creating a de facto defense industrial common market. Increasingly symmetric access to advanced nonnuclear defense technology promises to reinforce the geopolitical aims of the US and its allies. In particular, Japan has an opportunity to reinforce the allies’ shipbuilding capacity.

The US Cannot Meet Allied Demand

In Europe, tactical aircraft and ground forces dominate, and the US is a major supplier of weapon systems. But the Indo-Pacific’s vast area means that naval forces are the most crucial contributor to deterrence in the region. The US Navy remains the most powerful regional force. But from a defense industrial perspective, the United States is not a major exporter of naval combatant vessels.

The Biden administration decided not to include funding to upgrade America’s naval shipyard manufacturing infrastructure in its $1.6 trillion infrastructure legislation. But because the administration has only been able to allocate 17 percent of these appropriated funds over a three-year period, a subsequent administration may be able to fund the renewal of US naval shipbuilding infrastructure.

However, at present, the US Navy continues to shrink. Thirteen ships will be decommissioned in fiscal year 2025 (FY25), leaving 287 in active service. This is less than half the size of the Navy’s fleet at the end of the Cold War. Under current circumstances, the US cannot build a sufficient number of ships to export a significant number to its allies. This is unlikely to change, as the FY25 US defense budget is the lowest since 1940 relative to the US gross domestic product (GDP).1

Japan’s Advantages as a Naval Combatant Ship Exporter

These circumstances offer Japan’s shipbuilding industry a profound opportunity to become a major exporter of naval combatant vessels, especially in the Indo-Pacific. Below are five reasons why Japan already has the core elements to fill this role.

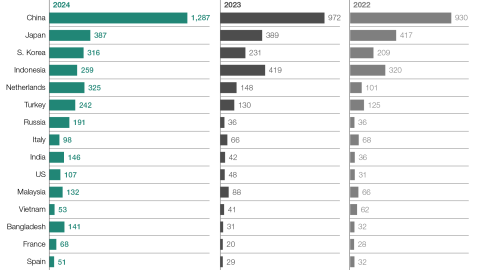

1. Japan has substantial shipbuilding infrastructure. Figure 1 shows that Japan is the leading commercial shipbuilder apart from China. China differs from Japan and other shipbuilding nations because it has dedicated considerable state resources to increase its civil and military shipbuilding capacity, often producing both types of ships in the same shipyard. Jiangnan Shipyard near Shanghai is a useful illustration of China’s dual-use shipbuilding infrastructure.

Figure 1. New Ship Builds by Country

2. Japan has a history of revolutionizing shipbuilding technology. The Japanese shipbuilding industry’s technology investment enabled it to significantly increase productivity. This is why Japan is an experienced and capable producer of hull machinery equipment for naval vessels. Japan’s investment has also enabled it to become a leading producer of highly automated commercial vessels. The Japanese shipbuilding industry was the first to introduce automation to produce modern merchant ships at scale. This significantly reduced manning levels, a crucial capability as navies face unsustainable manning requirements with current technology.

3. Japan is a leading contributor to the development and production of advanced materials. Along with helping Japan produce traditional naval combatants, this competency could enable Japan to become a major supplier of uncrewed surface and subsurface naval systems. This development could be crucial for Washington because the US Navy expects that 40 percent of its fleet will be uncrewed by 2050.

4. Japan could soon see an increase in naval shipbuilding orders. An early opportunity exists for Japan to develop its naval shipbuilding capability. The Royal Australian Navy, which currently operates 11 surface combatants, plans to retire several older ships but grow its combatant fleet to 26 ships. Japan’s stealthy Mogami-class frigate is among those being considered in competition with European and South Korean suppliers. The Mogami-class is reminiscent of the similarly stealthy American Zumwalt-class destroyer. Although the US planned to produce 32 Zumwalt-class ships, only three were built before the program was canceled in April 2009.

5. Japan’s defense industry is closely aligned with America’s. Japan and the US have considerable overlap in advanced technology for naval vessels like radars, missiles, and other weapons and communications systems. As a result, Japan can produce state-of-the-art combatant vessels that can integrate easily with US forces.

Recommendations: How Japan’s MoD Can Step Up

In 2016, Japan attempted its largest-ever defense export initiative: the sale of Sōryū-class air-independent propulsion submarines to Australia. Due to close relations between the Japanese and Australian governments, Tokyo was confident that the sale would be approved. However, Australia selected a French submarine produced by a government shipyard instead. Australia’s concern was that the Japanese government would not be willing to export the relevant technology to permit construction in Australia. Canberra was also concerned about the Japanese shipyard’s lack of experience in international defense transactions.

Now, Japan’s naval shipbuilding industry has a second chance at the Australian market. The AUKUS agreement caused Australia to cancel its purchase of French submarines. This coincides with the Australian government’s plan to modernize and expand its surface fleet. However, Japan may still encounter difficulty in the export of its defense products.

Below are two institutional changes that would permit Japan’s defense industry to become a leading exporter of defense products, including naval vessels.

1. Japan needs a Ministry of Defense–based organization to manage government-to-government sales or transfers of defense equipment and services. This entity would be analogous to the US government’s Foreign Military Sales system, which is managed by the Defense Security Cooperation Agency. There are numerous reasons this is a crucial step to increase Japan’s capacity to export defense products and services.

(a) A government-to-government apparatus is essential to assuring buyers that the product will be supported throughout its service life. Japan’s technical advantage is often based on a large number of small firms in its supply chain. The buyer of a long-term asset like a naval combatant vessel cannot rely on small, individual suppliers for access to spare parts and subsystem upgrades. A government entity that guarantees lifecycle support is critical for this assurance.

(b) A government defense export entity would enable the MoD to have a representative deployed as a Japanese diplomatic presence in the partner nation. The equivalent program in US embassies, the Office of Defense Cooperation (ODC), is led by a military officer. This representative provides a source of support during the “marketing” process, and acts as a knowledgeable liaison with the buyer after the product is in service.

(c) A governmental defense export entity can be useful in coordinating the financing arrangements—public, private, or hybrid—to facilitate the export of the product. Complex modern defense equipment also requires sustained training support throughout the product’s lifecycle. Product improvements often emerge rapidly as software-driven changes become more frequent and substantial. A Japanese MoD presence could augment Tokyo’s international collaboration and coordination with defense partner nations.

2. Japan needs an intelligence community. Modernizing major platforms like naval combatant vessels requires the capacity to anticipate changes in adversary capabilities so that countermeasures and the development of overmatch capabilities can be produced, fielded, and supported. The Five Eyes (FVEY) alliance among the US, UK, Canada, Australia, and New Zealand is the foundational transnational alliance of intelligence organizations. Its role is sometimes mistaken as an intelligence sharing entity; while the alliance does share intelligence, FVEY is primarily an intelligence production entity. The alliance has established three rings of collaborative relations: the Nine Eyes, the Fourteen Eyes, and Partners of the Fourteen Eyes (which includes Japan). Japan needs a more robust intelligence collection, processing, and dissemination capability to be able to effectively support the development of modern surface and subsurface naval platforms, both crewed and uncrewed.

Japan’s technological and industrial capability to become a major naval shipbuilding exporter is apparent. If Tokyo overcomes these institutional obstacles, Japan could become an even greater US partner and contributor to Indo-Pacific security.