To a remarkable degree, the two most important and basic methods for conjecturing, forecasting, or studying the future are (1) relatively straightforward, simple extrapolations from current trends (but with the rate of innovation included in the current trend), and (2) the more or less obvious use of historical examples. Although many futurologists object to simplistic extrapolation, it is a matter of record that in many cases journalists and social commentators have used simple extrapolations to predict the future better than have very skilled scientists and engineers. Also, those knowledgeable in history have done better than those who confine their thinking to the present. Of course, any method may be abused, and the very simplicity of extrapolation and historical analogy lends these areas to abuse; nevertheless, they are the most basic, important, useful, and flexible tool we have.

The simplest extrapolation model is a straight-line projection in which past data fit a fairly linear function, and in which it is assumed that future data will also fit this same linear function. Normally, this is true for uncomplicated phenomena or because the analyst chooses a coordinate system that produces a straight-line curve.

It is important not to confuse these two basic models. Many phenomena of interest to futurologists appear to increase more or less exponentially for a period of time, perhaps at a varying rate of growth, but they reach a maximum growth rate and then pass through a point of inflection. From that point on, the rate of growth decreases until the curve more or less flattens out. This is the expected curve for world population or gross world product.

It is of the utmost importance to try to understand when and why these curves will turn over or flatten out. For example, in a Hudson Institute study of the Prospects for Mankind, it is argued that the expected curve for world population and gross world product will turn over mainly as a result of urbanization, affluence, literacy, new birth- control technology, the adoption of current middle-class values and style of life, and other changes in values and priorities. That is, the flattening comes from the effects of relatively free choices by billions of people who decide to have fewer children and eventually decide not to work so hard to increase their income. We do not expect that, worldwide, the curve for population and gross product growth will be strongly influenced by famine, pollution, or limitations of nonrenewable resources.

In dynamic situations, particularly in technological and economic growth rates, the crucial issue is the estimation of the rate and character of innovation. Experts often have the greatest difficulty in dealing with this. After all, if they knew how something was going to be done in the future, they would do it that way now. Indeed, often the expert does not really understand his own inability to accept the fact that such innovations will occur. He may feel, therefore, that a less expert individual who does accept this premise must be giving insufficient attention to countervailing forces or other problems.

Clearly, however, the dynamism of demographic, technological, or economic change will depend very much on the surrounding social, political, and cultural milieu, as well as on the innate characteristics of the population, technology, or economy. These sociopolitical factors are especially important in the case of population growth. For the world as a whole in the last thirty years, population growth has been relatively steady. For individual countries, few analysts have been successful in making twenty-year or thirty-year projections of population growth.

Where political and socioeconomic factors dominate a rate of change, it is very often difficult to project beforehand how rapidly these factors will be dealt with by the governing institutions. In northwestern Europe and North America, we can be reasonably confident that problems of environmental pollution and ecological damage will bring about major corrective actions rapidly; in fact, progress in these areas in the last several decades has often been remarkable. This points out that it is necessary not only to rely on past data but also to analyze and make judgements about the driving forces behind the rate of change. Often an analyst will use past data as a basic trend and analyze its causes to determine the extent to which the basic trend should be modified.

An equally difficult choice concerns the appropriate baseline on which to base an extrapolation. Consider, for example, a country that has maintained a 2 percent growth rate for a long period but has shown a 6 percent rate for the past ten years. One could choose either the previous decade or the long-term trend as the most relevant base, or the analyst could choose some average between the two. The choice would depend very much on the analysts judgment about the underlying forces responsible for the growth rates and for the change in growth rates. The more recent data might be a special situation related to highly specific and no longer continuing causes, some other kind of aberration, a catching up, or a fundamental change in the countrys dynamism. It is usually possible to rationalize the choice of a baseline and the choice of the determining socioeconomic forces used in making a projection, and very often the rationalization turns out to be justified.

Thus it is often essential to examine the mechanisms behind the data or functions being extrapolated. In relatively complex situations, some set of interacting phenomena is being projected, and not all the interactions will play the same role in the future as they have in the past.

In examining these complex situations, two very different attitudes and types of analysts might be described, using an analogy from the stock market, as the chartists and the basics. The chartists concentrate on examining the prices on the stock exchange, and argue that the flow of stock prices, by integrating the judgments of buyers and sellers, is the best predictor of future prices. The basics, on the other hand, examine the data and institutions behind these prices, and analyze companies, the economy, and other economic, technical, political, and social factors that may affect the flow of prices. They use current price information but do not let the pattern of these transactions dominate their thinking. The chartists often reject the extra information and analysis, believing that such data will inundate them with too much information and thereby impede their intuitive and perhaps subconscious judgment. Instead, they may substitute the use of regression formulas, methods of extrapolation derived from statistical theory, or other special theories, to impose a pattern on the flow of economic data.

A similar difference in attitude and technique separates bettors on horse races. Some focus attention on the track record, and others concentrate on the heredity and other basic characteristics of the horse. All these attitudes and techniques are applied in futurology studies as well as in the stock market and at the race track, and each has its own strengths and weaknesses.

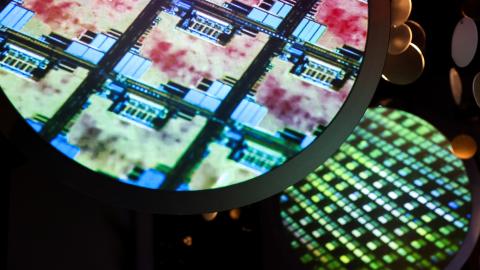

Caption

Global Autonomous Reconnaissance Craft (GARC) from Unmanned Surface Vessel Squadron 3 (USVRON 3) operate remotely in San Diego Bay on May 15, 2024, ahead of the unit’s establishment ceremony. (US Navy photo by Mass Communication Specialist 1st Class Claire M. DuBois)