A month after announcing its decision to stop selling cigarettes at its 7,660 drugstores, CVS Caremark Corp. continues to bask in the limelight for the move. To be sure, giving up $2 billion in top-line revenue (about 2 percent of total) is not something any company would consider lightly, especially one with public shareholders. Yet CVS’s move is actually not an anomaly. For several decades, companies such as Danone, Apple, Costco, and Disney have jettisoned profitable but controversial products or practices because they stood in the way of more profitable opportunities. CVS is only the most recent example, and it certainly won’t be the last. The reason: Companies in many industries are recognizing the profit potential of more socially acceptable products and practices.

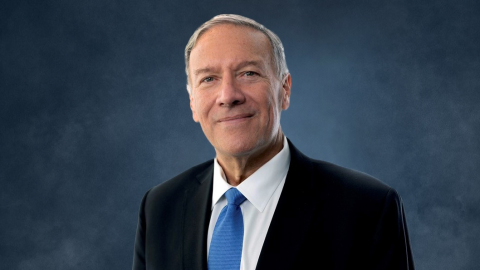

Like a chess player who sacrifices a valuable piece to set up a winning move, CVS, a $126 billion pharmacy and health care provider, sacrificed cigarettes to position itself as an attractive provider in a revamped system for delivering care. The company’s chief medical officer, Troyan A. Brennan, said as much in a February 5 article in The Journal of the American Medical Association. He said CVS made the shift because companies that are “retooling themselves as an integral part of the health care system” should not sell cigarettes. While the public accolades are nice for a while, companies like CVS don’t give up a profitable line of business unless it is in their best long-term financial interest to do so. What CVS did is what I call having a moment of profitable morality.

Twenty years ago, the French yogurt maker Danone had its such moment. Its chairman, Franck Riboud, saw the handwriting on the wall: a consumer trend toward healthy food. He carefully chose product lines that he thought would grow, especially in emerging countries where Danone wanted to expand. So between 1994 and 2007, the now $20 billion company jettisoned beer, meat, cheese, and biscuits and acquired a baby formula company. Riboud was savvy about reading the tea leaves: In the first 10 years of his tenure, the cookies and crackers division grew only 3 percent, compared with nearly 15 percent for bottled water and 9 percent for dairy products. Under Riboud’s stewardship, Danone has enjoyed not only a healthy public image but also a healthy bottom line. During a recent five-year period, its operating income growth was 76 percent higher than its peer companies’, according to a Hudson Institute study.

Apple, too, has jettisoned questionable practices in the interest of long-term profitability. In 2010 the company yanked 6,000 sexually suggestive apps from iTunes. From July 2009 to July 2010 a conservative estimate was that 13 percent of all web searches were for erotic content; other estimates on porn traffic have been much higher. Former Apple CEO Steve Jobs took some heat for his decision to give Apple customers “freedom from pornography.” But he had a vision for the kind of customer experience he wanted his products to provide, and he knew that porn sites often spread the personal computer’s version of STDs—malware and viruses. His bold move did not hurt Apple, whose devotees value its virus-resistant products and whose stock doubled from $212 in early 2010 to $420 in October 2011, the month he died. Jobs looked like a saint to both moms and shareholders.

Along with getting rid of a product, sometimes taking a stand on a controversial issue—and in the process alienating some potential customers—can be key to a company’s image and appeal. Take the issue of permitting guns in stores. Both Costco Wholesale and Starbucks prohibit carrying firearms in their stores, regardless of whether local laws allow it. Starbucks took this stand last September after being caught in the crossfire between pro-gun and anti-gun activists; the financial impact of the new policy is not yet clear.

But the $105 billion retailer Costco, which neither sells guns nor allows anyone except police officers to bring them into its members-only warehouse stores, doesn’t appear to have suffered one bit. It remains the biggest of the big three U.S. warehouse club retailers (ahead of Sam’s Club and BJ’s), and its revenues have increased more than Sam’s in recent years, according to the securities analysis firm Trefis

I imagine that Costco’s moment of profitable morality was rigorously debated internally. Its gun policy risks alienating part of its target market; the rate of gun ownership peaks among families earning from $60,000 to $110,000 per year, and Costco wants those higher-income people. (A 2005 New York Times article said the average household income of the retailer’s customers was $74,000.) No doubt some of those gun-carrying customers have defected to rivals such as Sam’s Club, which doesn’t sell guns either but permits customers to carry licensed firearms in its stores if local laws permit. (Sam’s Club’s parent company, Walmart, sells rifles, shotguns and ammo online and in about 1,800 of its stores. The gun ban wouldn’t be Costco’s only bold move; its insistence on paying employees much higher wages than its rivals has attracted "some skepticism from analysts(Decency Means More than “Always Low Prices”:

A Comparison of Costco to Wal-Mart’s Sam’s Club):http://www.ou.edu/russell/UGcomp/Cascio.pdf. But while competitors have lost customers to the Internet and weathered a wave of investor pessimism, Costco’s sales have grown 39 percent, and its stock price has doubled, since 2009. In short, its strategies have worked, so nobody is complaining, not even many gun enthusiasts, who say they will just "hide their weapons better when they shop at Costco.

Over the past eight years, The Walt Disney Company has had an ongoing campaign to promote healthier food choices for children. In 2006 the company introduced new and stricter food guidelines for its theme parks. For example, it replaced French fries and soft drinks in its children’s meals with carrots and low-fat milk. In 2012 Disney announced that it would no longer run junk food ads on its TV and radio stations, sacrificing a share of this $2 billion market in advertising to children. Citing increased sales of healthier foods at its theme parks, Disney Chairman Robert Iger said, “This is not altruistic. This is about smart business.” Investors appear to have bought his view. Disney’s stock price has doubled in the past two years.

These historical examples show that the “halo effect” from making a well-publicized change benefiting public health can only go so far. A sound business strategy has to be behind it, and the company must know when it’s worth making the leap. Somewhere between “doing the right thing” and cantankerous shareholders there may be a sweet spot that ultimately benefits everyone.

More such sweet spots will emerge over the rest of the decade—that is, more opportunities for companies to exercise moments of profitable morality. Why? Health care reform is forcing a big change in how health care is delivered and a fresh focus on prevention and lifestyle. (Running outpatient clinics in drugstores like CVS’s is just one of many changes.)

What’s more, America’s 80 million socially conscious millennials, who account for $600 billion in spending each year, are heavily influenced by social media, where both good and bad perspectives on a company’s products or practices spread quickly. A 2010 Edelman Communications study showed that one in three millennials looked for brands “to make a positive impact on the world.” And in a 2013 study, 31 percent of global consumers said they believed that businesses should change the way they operate in ways that help address social and environmental needs. Only 6 percent agreed that “businesses exist to make money for shareholders and are not responsible for supporting social and environmental issues.” What this says is that if you’re selling to millennials who don’t like what your products and practices stand for, you’re in for a tough slog. They are not nearly as likely to ignore what you do and sell as their baby boomer parents.

The best companies are already figuring out how they can profit from these new trends and make themselves more appealing to socially aware consumers. They are devoting their sharpest minds to figuring which of their products can thrive as the market changes, and de-emphasizing or eliminating the ones that no longer make sense, as CVS did. Those who can successfully seize opportunities for profitable morality will discover, in Danone CEO Riboud’s words, that “business success and social success go hand in hand.”