Implementation this year of the Tanker Security Program (TSP) will mark the first time in decades that the U.S. government has significantly expanded the U.S. flag commercial fleet operating in international markets. The significance of this decision should not be overlooked. It reflects a continuing shift in attitudes about the American maritime industry, a recognition that this industry is indeed important to our national and economic security and that basic U.S. policies affecting the industry must do more to support it.

Three forces have driven this shift. Most Americans now recognize the emergence of China as a global competitor and the threat to basic American values if China succeeds in reshaping the global order. China’s enormous government investments in its commercial shipping and shipbuilding industries have produced an important addition to China’s arsenal to engage in gray zone, economic, and, if necessary, military activities against the West.

Second, pandemic-related supply chain shocks have laid bare the fact that, except as primary users of the system, Americans have essentially no control over the maritime logistics supply chain delivering all or part of nearly everything. This glaring vulnerability should raise serious concerns from an economic security standpoint. China’s explosive growth in commercial shipping, shipbuilding and ports adds a separate dimension to this risk, where potentially catastrophic damage to American economic interests could be inflicted by the intentional, malign acts of a geopolitical rival. According to a November Report by the Fitch Rating Service –

“Geopolitical tensions between the U.S. and China will continue to escalate, but economic linkages and interdependence will most likely unravel slowly…. A sharp unravelling of Sino-U.S. economic ties in the event of a military confrontation over Taiwan would deliver a global supply shock of catastrophic proportions. Such a scenario falls outside of Fitch’s expectations but cannot be ruled out entirely. In the absence of such a conflict, we expect decoupling to be slow, challenging, and to face resistance from commercial stakeholders.”

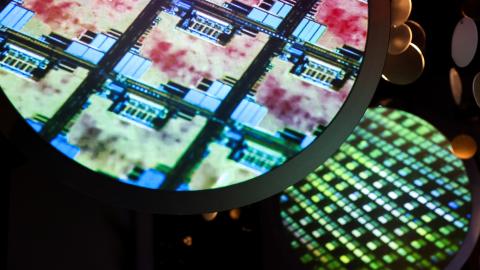

Americans have reached a near consensus that excessive Chinese control over certain refined commodities (e.g., lithium and rare earths) and overreliance on East Asian allies (and increasingly China) for microchip manufacturing present unacceptable risks. Similarly, China’s increasing control over commercial shipbuilding and the maritime logistics supply chain bringing those products – and everything else – to the U.S. is not broadly known, and how China might leverage that control to harm American interests is not well understood.

Third, the Russian invasion of Ukraine has demonstrated the continued importance of industrial capacity and logistics in winning a military confrontation. While the logistics challenges in Ukraine primarily involve land-based operations, a potential conflict with China in the Western Pacific would have maritime logistics front and center, radically increasing the complexity of resupply operations and elevating the criticality of U.S. maritime capabilities.

America faces steep challenges in developing effective responses to these concerns. Existing American shipping and shipbuilding capabilities are inadequate. Collaboration with allies that have more robust commercial maritime capabilities is necessary but comes with certain drawbacks and limitations. Because the solutions are difficult there is a temptation to ignore these concerns and to assume that market and other forces will take care of things. We may indeed hope that assumption is correct. But hope is not a strategy, and we should assume that the actor across the ocean, who has the benefit of overwhelming commercial maritime advantages, is intensely motivated to find ways of leveraging those advantages. We need answers.

A starting place for developing effective responses is to accurately diagnose how we arrived at this position. American policy since the Second World War has treated commercial shipbuilding and international shipping services on a globalized, free-market basis. Intense competition, tax disparities and the lack of any floor protecting worker rights and other regulatory standards meant that American commercial shipbuilders and U.S. flag shipping had to compete in international markets on a wildly unlevel playing field.

Compounding these inherent and regulatory disadvantages is the prevalence of substantial government supports in the maritime industry. Shipbuilding and shipping were seen as stepping-stones for developing countries to build up their economies. Advanced economies including the U.S. mostly stood aside as the governments of Japan, followed by South Korea and then China invested heavily in their commercial shipping and shipbuilding industries through an array of subsidies, loans and other mechanisms. In 2013, shortly after assuming power, Chinese President Xi Jinping announced to the Politburo that China would become a “maritime superpower,” pumping the equivalent of tens of billions of dollars into China’s shipping and shipbuilding industry with the result we see today.

Facing these very substantial disadvantages, the rational decision for most American businesses involved in international shipping and commercial shipbuilding has been to exit those markets, just as the rational decision for most individuals has been to choose career paths outside the commercial maritime industry. Perhaps hedging against the challenges we face today, however, American maritime policy also sought to preserve a critical mass of Americans who know how to build and operate ships so that we have some American facilities and manpower that we can scale up if circumstances require it. The primary approach for keeping Americans in the commercial shipbuilding industry has been to reserve U.S. domestic markets for ships built in the United States. Preserving an American mariner workforce benefits from our domestic shipping laws and from U.S. government support to a handful of U.S. flag ships in international trades. It should be understood that these few very modest U.S. policies were not intended to make the American maritime industry generally competitive in international markets, and that in the absence of these policies, the American commercial shipping and shipbuilding industry would have become almost completely extinct.

The decision to fund the expansion of the US commercial maritime industry is thus a watershed event that involves numerous strategic and practical considerations. For example, adding ten US flag tankers to the international fleet, and then ten more next year, will require several hundred well-trained American tankermen that do not instantly appear at the stroke of a pen. Indeed, because the genuine requirement is for more than eighty additional U.S. flag tankers, a comprehensive government supported program is clearly needed.

Given the scope of the challenges outlined above, the National Defense Authorization Act signed in December mandates studies and reports into several relevant issues, including a comprehensive review of our national commercial maritime strategy.