Competing with China on Critical Minerals

Distinguished Fellow

Mike Gallagher is a distinguished fellow at Hudson Institute.

Founder, Chairman, and Chief Executive Officer, MP Materials

The United States’ abundant natural resources will be crucial to gaining the upper hand in America’s strategic competition with the People’s Republic of China. But to leverage these resources, the US needs to rebuild its domestic rare earths and critical minerals industries.

Hudson’s Mike Gallagher will host James Litinsky, founder, chairman, and CEO of MP Materials, to discuss the role of these vital resources in PRC-US competition and what Washington can do to emerge victorious.

Event Transcript

This transcription is automatically generated and edited lightly for accuracy. Please excuse any errors.

Mike Gallagher:

Okay, well, thank you all for being here. We are very excited and honored to welcome a friend of mine. It’s also very infuriating when I meet people that are around my age that have been exponentially more successful than me, and Jim is one of those people.

So despite my pathological envy of Jim and his career, there is no better voice in America or the world today to help us think through this issue of rare earths, critical minerals in the context of our broader competition with China. So please join me in welcoming Jim Latinsky, the CEO of MP Materials.

James Litinsky:

And you should know it was a love fest when I first saw you in Congress the first time I walked out and I said, “We got to get to know that guy better.”

Mike Gallagher:

Yeah. It was more reflection on the average member of Congress’s-

James Litinsky:

No comment.

Mike Gallagher:

. . . intelligence level. And you’re like, “That guy can form a coherent sentence together. We should invest some time in him.” But you were very generous in making yourself available to my committee, the Select Committee on China, participating in various events that we did.

But before we get into all that, and before we get into the future of US policy, just tell us about your journey that led you to found and share and run as the CEO, MP Materials. Because you didn’t start off in the industrial mining space, you know?

James Litinsky:

No.

Mike Gallagher:

Yes.

James Litinsky:

I jokingly say, “I’m an accidental industrialist.” I started out as a hedge fund manager. I had absolutely no expectation of doing anything real. I was moving numbers on a screen.

And the whole thing started, I remember I had noticed the predecessor, which you jokingly referred to as, it was like the Enron of mining. It was a total mess. And so there was this mining company in the rare earth space, and it was a really sort of exciting story about supply chain and all of this. And they spent a couple billion dollars building out a refinery at Mountain Pass. And I remember when it went public, and then I remember a few years later it was headed to bankruptcy.

And so I started kind of looking into the situation and the bonds had traded way down. And I’m like, “Oh, wow, this is. . . “ Apollo owned a bunch of the debt behind them. I’m like, “Oh, this is great. We can buy a bunch of the bonds at 40 cents, and they’ll figure out what to do with this thing, and we’ll make some money.”

Well, long story short, when it went bankrupt, it went into total freefall. The situation was Enron-esque in the sense of sort of what the market perception of what was happening at the mine and the build versus sort of the reality was very different. And I’ll say two years of bankruptcy litigation and a big saga, just suffice to say, not a single financial or strategic buyer showed up to buy this site.

And I found that odd because this represented the entire American rare earth industry, the entire supply chain other than one site, and Malaysia was in China. And I couldn’t believe that this very unique, strategic, militarily strategic asset, especially with electric vehicles on the rise, and we can kind of talk about rare earths and what they’re in, but I couldn’t believe that this was just going to go to reclamation because that’s what the court plan was.

And so, almost out of a movie on the courthouse steps, we kicked in some money just to keep it in care maintenance to figure out a plan. And then, I ended up putting a group together to buy it at a bankruptcy, relaunch it. So when I bought it at a bankruptcy, it was eight employees in care maintenance. This is multi-billion dollar site. We had no accounting infrastructure. It was nothing. It was like, “Congrats, you bought a mine.” Had no corporate anything.

And then, so it was sort of like a startup and a distressed turnaround at the same time. And fast forward to today, and we’re now about 800 people. We’re public. We relaunched it. We now produce approximately 10 percent of world rare earth supply and 100 percent of the US supply.

And then, we moved downstream, and we can talk about that. But we built a magnet factor in Texas because it doesn’t do any good if you have all the rare earths in the world, if the end product is still in China, you’re going to China. And so, we built that factory. We can talk about that, but that is the last 10 years in a nutshell.

Mike Gallagher:

So when you had this idea, what did your colleagues in the world of high finance think of this career departure for you?

James Litinsky:

They thought I was utterly insane. And I jokingly say, “If I knew what I was getting into, there’s no way I ever would’ve done it.” Obviously, it was incredibly challenging. The first few years, every day we were on the precipice of what we call a 22, which would’ve been just another chapter 11, sort of a second one.

So it was very hand-to-mouth in the beginning, but it worked out. But there were a lot of my investors. . . I had run a very successful hedge fund for over a decade prior to kind of doing this. And my investors were like, “What are you doing? You think you can run a mine?”

So there were a lot of tough conversations, but it worked out. It was actually, it was a $30 million side pocket for the fund that ended up becoming a multi-billion dollar gain. So the investors who participated were very happy, but it was a tough process to say the least.

Mike Gallagher:

Okay, so you made that transition. Let’s talk about MP Materials itself. So MP stands for Mountain Pass. What is this? What is mountain Pass? Where is it? Why is it important?

James Litinsky:

Okay, so if you’ve ever done that drive on I-15 from Vegas to LA or LA to Vegas, you can actually see it from the highway. It’s an enormous site. It’s several thousand acres.

Mike Gallagher:

By the way, the drive to Vegas is always better than the drive back. You’re in a different state of mind.

James Litinsky:

So if you get out of the car to throw up, odds are you might’ve done it near our site. It’s just over the border in California. And basically, they were originally looking for uranium and other nuclear materials back in the ‘50s. That’s how this site was discovered. And it had operated, this was the rare earth industry of the world for decades.

And then, about 20 years ago, the Chinese took over the industry, and we can talk about that, but so this site was sort of a very storied site. But because of the Chinese taking over the supply chain, it was really incapable of operating at a low enough cost.

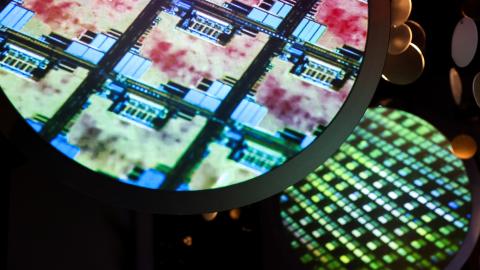

And so, a new group came in and with a grand plan to build this enormous state-of-the-art refinery that could get costs down and could serve the market, and obviously, it was a complete disaster. But what’s interesting about rare earths is I think people think that it’s sort of you mine. . . They think of a big open pit and you take some rocks out and put them in a bag and send them somewhere.

And actually, rare earth mining and refining is really much closer to a specialty chemicals process. To take these things and make them into a saleable product, you have to concentrate it, and then refine it in a very meticulous way. And so, it really does, if you look at the pictures on our website, it looks a lot more like an oil refinery than it does a mine.

And then, as far as MP, so we went public in 2020. Our long-term vision was, we said when we were going public in ‘20, “By 2025 plus we’ll start thinking about a magnet business because we can sell these things, we can sell some to Japanese magnet makers. But at the end of the day, the Apples, Teslas, GMs of the world buy all their magnets in China. And so what good is having some part of a US supply chain if we can’t do it all?”

And so, we then built a magnet facility in Alliance, Texas. We have a big deal. We’ll be the key supplier for the GM electrification platform. And so, that factory, we broke ground on that in April of ‘22. We have completed that. And we’re now going to be, by year-end, we’ll be selling a precursor material magnet product to GM. And then, by the end of next year, and we’re qualifying magnets by year-end, and then by the end of next year, we’ll be selling magnets to GM.

Mike Gallagher:

So surely-

James Litinsky:

So with fully US mine to refined.

Mike Gallagher:

So surely in America, and given the importance of rare earths and given the interest in EVs, we have many of these mines scattered around the country, correct?

James Litinsky:

Unfortunately. . . Well, the funny thing is that your backyard is a rare earth mine. If you have a backyard, you have rare earths in it. And so we often, I think, we get a call. I get a call-

Mike Gallagher:

I thought you were talking about Michigan, Wisconsin’s back yard.

James Litinsky:

I’m sure there’s one in Wisconsin.

Mike Gallagher:

Yeah, yeah, yeah.

James Litinsky:

But these are in every piece of rock. And so, we’ll often hear stories of. . . I jokingly say, “Whenever someone wants to do something with respect to the US or NATO. . . “ You see news of a big find. Turkey had a big find. And then when, I think, Finland and Norway had a big find. And the challenge is you can take any area of rock and take 0.02 percent rare earth and multiply it by the price and come up with and say, “I have a $10 billion rare earth mine.”

What they don’t tell you though is it would cost a hundred billion to extract it. So to me, that’s not a rare earth mine. So unfortunately, due to economic. . . So there are unlimited rare earth mines. Economic rare earth mines, there’s one in the US. That’s us. There’s one in Australia, and then everything else is basically in China.

Mike Gallagher:

Are there other sites where the extraction would be possible and economically feasible, but the regulatory environment just makes it impossible to explore?

James Litinsky:

Yes, but it’s even harder than that. There are some other sites, but at today’s prices. . . So just as an example, we were very profitable two years ago. About 18 months ago, the Chinese took the price, because they control the industry, they took the prices down about 70 percent. A lot of that was Chinese macro, but I think some was sort of maintaining control.

And so, the reality is the Chinese industry today basically loses money at these prices and so does the rest of the industry. And so, there are some other sites. I think we could certainly bring those online, whether in the US or in other allied nations around the world. But realistically, there’s no prospect of that from an economic standpoint, which is something we can talk about, because the Chinese have the prices to be so far below the incentive cost of production.

Mike Gallagher:

So basically, when it comes to this, a critical component of our competition with China, we have MP, we have our friends in Australia, and that’s pretty much it.

James Litinsky:

Yes.

Mike Gallagher:

Okay.

James Litinsky:

Yeah.

Mike Gallagher:

All right. So you’re a very important person, in other words.

James Litinsky:

Well, if I’m on stage with you, I must be.

Mike Gallagher:

That’s true. That’s true. Flattery will get you everywhere. Okay, so talk about then, situate MP and your production in that global context. Do the relative assessment of you versus China, and just how dominant is China’s position in the market? And translate it in terms that make sense for those of us who studied liberal arts in college.

James Litinsky:

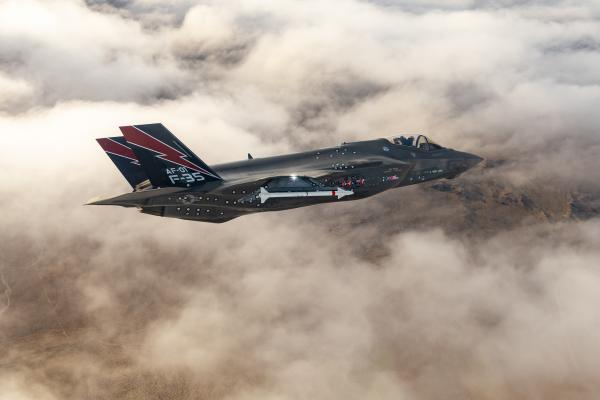

Sure. Sure. Well, in really simple terms, the magnet, and ultimately it’s high-powered magnets. So rare earths are a nice sounding thing, but it’s the magnets in EVs, wind turbines, robotics, missiles, obviously, I’m sure many people have heard. We can talk more about that, but it’s the magnets that actually are the end product.

And so, the Chinese effectively control north of 90 percent of the magnet business. As you move a little upstream, they have a little less of the refining because both us and a company in Australia refine. And then, as you move a little further upstream, both of us make a more concentrated product.

And so, the reality is that the Chinese completely control the price. They can set prices anywhere in the supply chain that they want. And you’ll see sort of different economics throughout the supply chain, depending on kind of what policy they’re trying to achieve. But for all intents and purposes, the world is a price taker from whatever Chinese government policy is.

Mike Gallagher:

And I assume it is Chinese government policy to massively subsidize that industry-

James Litinsky:

Yes.

Mike Gallagher:

It’s the losses that they were subsidizing.

James Litinsky:

That’s the big challenge. And there just isn’t a level playing field. So if I want to sell into China, there is a VAT and they have a tariff on rare earths. So we are at a 40 percent-

Mike Gallagher:

A VAT and a tariff.

James Litinsky:

A VAT and a tariff. So we’d be at a 40 percent disadvantage to sell directly into China. Whereas if we wanted to sell a refined rare earth into China. . . We can sell a concentrated product with just VAT. So the point is that they really control it and economically we’re really important. But if they decide to take the prices to whatever level, then that can be the end of the global industry.

Mike Gallagher:

Interesting. That would be bad, I assume.

James Litinsky:

Yes, I think so.

Mike Gallagher:

But help us understand why. Beyond the fact that there are those who want to buy electric vehicles, you need magnets for those, what else is this important for?

James Litinsky:

What they do, and I should have. . . You asked this and the other thing beyond the tariffs is when you think about the level playing field, there’s effectively no cost of capital in China. In the US, I run a public company, I’m a fiduciary. If I want to do a project, I need to have a return on capital. The Chinese producers, their entire rare earth industry consolidates up into two major groups. There’s what is China Northern and China Southern, which is China Rare Earth Group. And so those two entities are effectively the Chinese government and they have a free or a negative cost of capital. And then as you move further down the line, obviously labor is cheaper, reagents are typically either free. In fact, the largest piece of our cost structure well beyond labor are reagents like acid and caustic and some of the other things that we need to produce the product. Those are enormously expensive. They’re effectively free.

Mike Gallagher:

Those come from China as well, or-?

James Litinsky:

No, those come from the US. Those are actually pretty standard things. You actually have to pay for them and transport them. They have a real price. And so there are things like that. And obviously there are environmental and regulatory differences to say the least. And so when you add all of that up, this is not a level playing field in the least. And so when we talk about tariffs or tax credits or other policy, it’s not that we’re looking to be isolationist, but it is not a level playing field at all in a very big way.

Mike Gallagher:

And then what would your magnets be used for in a more pure national security context as opposed to just electric vehicles?

James Litinsky:

I think the big use case that it’ll be increasingly apparent and really critical for all of us to think about are robotics. So you may hear people talk about autonomy and with EVs, and an EV is a robot on wheels, and a humanoid robot is a robot on legs. The way a robot moves are actuators and an actuator is effectively a rare earth magnet or a high-powered magnet. And so the content for a robot is typically at least two to five times that of an EV. And so if you believe sort of the Musk vision of the world of, “We’re going to have billions of robots, we’ll have one to do chores and work in factors,” etc, the scale that we will need is enormous, the amount of product.

But the tough thing also is this supply chain. We’ve already lost the EV supply chain. It’s gone. Obviously the upstream, the entire EV supply chain is controlled by China. We haven’t yet lost it in robotics because it’s so early. But that is why I think it’s sort of a really critical issue for us to discuss is because this will be really important in robotics. And then an extension of robotics are drones and eVTOL. So think of it as any kind of electrified motion, whether it’s a robot or a robot in the air. These are going to require rare earth magnets.

Mike Gallagher:

Okay, let’s put a flag there and come back to how we might avoid losing the robotics supply chain and just go back to just core rare earth’s magnets in general. You interacted with my committee a lot. You provided input into our final policy report, which was called Reset, Prevent, Build, was kind of economic and technological strategy. We had a section in there on rare earths and critical minerals. Maybe talk us through, if you were down in Mar-a-Lago right now advising whoever is emerging as secretary of this and that, what would be the common sense steps we can take in the next year actually that would wean ourselves off of our dependency on China in key areas and allow companies like yours to fight on a level playing field?

James Litinsky:

Sure. So I can think of a couple major things that I think will have very high impact that I think can actually get the job done. And I want to start by saying philosophically I think that we need to have a supply chain that is self-sufficient, private market oriented. It can’t just be sort of one national champion. It’d be nice if we are the national champion, but it’d be good if there were at least a couple others, a broader supply chain. And I think there’s. . . Certainly tax credits help any company in the space.

Mike Gallagher:

Wait, could I stop you?

James Litinsky:

Yeah.

Mike Gallagher:

Philosophically, would you say that pertains to your industry because of its unique nature and the national security implications or across the board for materials?

James Litinsky:

Well, I think every materials vertical is a little bit different. So for example, lithium is ubiquitous. That is a little bit more of just kind of a money issue and that supply chain is diverse, ubiquitous. We won’t have a problem with lithium. That’s global, that’s everywhere. I don’t think we need to worry about that because there are projects in South America, there’s projects in Arkansas, there’s projects in Nevada, California. It’s all over the place. I think they’re going through a challenging cycle with prices and the Chinese have taken prices down. And so we do need to think about long-term pricing from sort of mercantilist policies, but that is a broader supply chain.

In rare earths, I think it’s leaning towards more we’re going to have one or two national champions. I mean we have achieved now the full supply chain or we’re on the precipice of it. We obviously are a logical national champion because we’ve got the one site and we have shown we can be successful. And so to the extent that we can, and obviously this is self-serving, but to the extent that we can scale and be able to grow our business and be more successful, it’s an example of a national champion that can exist. And frankly, the Chinese industry has two champions and that’s it. But beyond that, I think as far as general policy, an idea I had recently that I’ve discussed that I think is probably something. . . If I were in Mar-a-Largo right now, kind of talking about how do we do this in a way that sort of fits our principles-

Mike Gallagher:

Pretty much the only person that isn’t in Mar-a-Largo.

James Litinsky:

Right. Exactly. Is I would actually look at the agriculture industry as an example. So if we go back to the 1930s, there was concern during the Great Depression about our food supply. And then the Dust Bowl kind of came through, bankrupted a lot of farmers. And the reaction to that was in 1938, the Federal Crop Insurance Act, and that established the Federal Crop Insurance Corporation and what that was, and it took. . . Frankly, it took a few decades before it had really substantial impact, but the concept was it was a public-private partnership, a government reinsurance corporation that allowed private insurers or public companies, but private market insurers to insure farms around the country to basically provide revenue and weather protection, et cetera. Obviously weather is not an issue for us, but the key issue is Chinese mercantilist policy.

When they see capital forming in our space, do they take the cost of capital. . .? Do they take the pricing down so that no matter where you are in the supply chain, you can’t achieve success? And so I think if we could create a public-private partnership insurance corporation that could provide revenue protection for a few of the areas in the supply chain, i.e., the mining, refining, and magnet making, so that, for example, if you have a new mine in Wisconsin and everything’s great about your project and you want to raise the capital, the challenge you have is the Wall Street will say, “Well, yeah, I know you have the debt. I know you have the mine. This plan looks great. Mike, you’re great, but the Chinese can just put you out of business right when you’re coming online.” But if you could buy an insurance policy that was set at the incentive cost of production for a decade post-operation, now you have to deliver to collect on that policy, that would have the effect of eliminating the mercantilist risk from your investors.

And I think it would be a lot easier to raise capital, to form capital, and you could create more of an industry around it. Lastly on that, I think that that would have the effect of an economic mutually assured destruction where the very existence of this program would show the Chinese that mercantilist policy won’t be successful. And so it would eliminate their likely willingness to do it because they know it’s not going to be successful. So why lose billions of dollars subsidizing the world? And so I think if we could figure out a way to get a program like this in place where we can show to the Chinese that there’s mutually assured economic destruction in this vertical or another verticals that we’re interested in, I think we can, in a very low cost way, get the private markets to do something to get this supply chain going.

Mike Gallagher:

How do you think about that in the context of this broader debate about our tit-for-tat tariff war with China, whether we’re going to use the existing three-on-one paradigm, impose 30 percent tariffs across the board? How does that relate to your idea?

James Litinsky:

Well, to my idea. . . There’s kind of a couple questions in there. I think generally stepping back as just sort of a thinker, since we’re at a place where people like to think, I think there tends to be. . . I think when-

Mike Gallagher:

We do. We don’t just think at Hudson. We do.

James Litinsky:

I think there tends to be. . . You see, I watch a lot of CNBC, so I can hopefully catch you once in a while in the morning, but there tends to be sort of a very simplified academic view that tariffs are bad and we have to avoid them. We can’t be isolationists. And then there’s the Lighthizer view, and I lean a lot more towards that because I don’t think we have a level playing field. And I think that that policy is to make sure. . . Is to correct. So it’s not a magic wand. It shouldn’t be applied across everything. It doesn’t need to be applied to little umbrellas that get sold in Walmart or something, but I think it is an important mechanism of policy for certain areas, particularly areas of national security that we care about. And so I would be very in favor of doing it in sectors like mine where it’s just, “Hey, there’s not a level playing field. We’ve got to level it.”

Mike Gallagher:

Where to draw the line was always something I struggled with on the committee which is to say, I think there’s a certain subset of industries or things that people agree, but we don’t have a level playing field and there is a role for government intervention to level the playing field. Now the mechanism matters greatly because I’m very skeptical, for example, that our subsidies of the semiconductor industry are going to bear fruit. I mean, there’s a lot, it’s sort of an over-determined problem, but we can talk about that if you want, but I think everyone kind of agrees, semiconductors, pharmaceuticals, rare earths, energetics, there is a subset of things that we do need to wean ourself off our dependency on China. But where to draw the line is. . . The line is sometimes very opaque.

James Litinsky:

I totally agree with that and I’m skeptical on what was the semiconductor policy of the last few years for that exact reason. If you can get a PhD in electrical engineering in Taiwan to work the night shift for $70,000 a year, that’s going to be pretty competitive relative to any subsidy you get here. And so you know that a lot better than I do. That’s why I keep going back to. . . I’m a free market capitalist. I think that the private sector tends to allocate capital the most efficiently. The challenge here though is that you have a sector that has a lot of positive externality for our country where this is a supply chain that we want to have, that strategically we need to have, but you’ve got to find a way to push the value of that externality into the sector.

And government can do that. And that’s why I like the idea of any way that you can create public-private partnerships where it’s not just sort of the public handing out money willy-nilly or just big programs that everyone get. It should be sort of the public sector helping in a way that is still part of our values of allocating capital efficiently. And that’s why, again, I really like the idea of an insurance corporation in our space, and I think you could do it in other sectors too, where we say, “This is a strategic industry. This is an industry that’s a victim of mercantilist policy. What is the incentive price of production?” And allow the private markets to figure out how to allocate that capital via qualified insurers. And then you would at least. . . Obviously there’ll be failures, but I think that there’ll be more incentive in the private markets to invest in those areas. And that’s the goal, is to get the markets to want to invest.

Right now, if you showed up to Wall Street and said, “I have a generic drug company. We’re going to make a penicillin equivalent in Arkansas.” They’d say, “Well, no, we can do it in China or India.” But if we could change the dynamic a bit with programs like this, and again, I don’t know that sector as well, but I think that there are some of those verticals where programs like this could free up capital to want to go into those things.

Mike Gallagher:

So public-private partnership when it comes to this insurance issue. Is there a deregulatory agenda that you think would make sense and help? Or is that just sort of a marginal improvement?

James Litinsky:

Some of these verticals tend to get sort of adopted. . . I was joking earlier about rare earths tend to be adopted by parties who have other purposes. It’s a great headline to grab like, “Oh, we have this, so now listen to us in this.” And so I think that permitting tends to be one of those things that sort of leads the discussion. It’s relevant, it’s important for sure. We should loosen that up. That should be part of something. But if we went out and just said, “Hey, no permits, go build stuff,” I still don’t think it would solve the problem. So I think it’s a component down the list that should be part of stuff, but it’s not going to give us a supply chain.

Mike Gallagher:

Stockpiling, am I correct to characterize you as skeptical of that idea?

James Litinsky:

Yes. Skeptical in the sense of, we’ll take it. We’re a company fighting China, economically competing, but it’s a one-time hit. It’s not a solution. It’s a one-time hit. It’s nice. It’s better than nothing, but it’s not a solution.

Mike Gallagher:

Yeah. How about structurally? In terms of the federal government, how the various agencies are structured or the NSC? I am just curious, has the government ever reached out to you? Have they ever incorporated your wisdom into an official war game? Who do you view as the point of contact in the national security community for these issues?

James Litinsky:

Well, I did participate in a war game. . . Is this a segue for me to ask you about-?

Mike Gallagher:

Yeah, I’d love to bring it back to my side. . . That’s right. That’s great.

James Litinsky:

I do have so many questions for you, but we do, we have conversations and we have a lot of visits. I think there is generally interest, and I think the good thing, and I know you experienced this too, this is a nonpartisan issue. I think there is a general strong interest on both sides of the aisle to figure this out. I will say that I do think when it comes in. . . Because I’m talking critical materials here, critical minerals, this supply chain, we are in the scheme of things a tiny issue compared to semiconductors, AI, some of these other bigger things. And I get that. And so I think we tend to be, frankly, collateral damage or sort of an afterthought relative to policy around those other bigger things.

And that’s fine. That makes sense because we’re just not as important as AI or semiconductors. But I would remind everyone that this upstream input does impact trillions of dollars of downstream market data. And when we talk about robotics and drones and warfare, I would put this vertical of importance along with those things. And so if we don’t figure this out over the next decade, this is a big time problem for us.

Mike Gallagher:

Okay. Before we talk about robots, let’s talk about humans. So you need to recruit humans to work in your facility, and the government needs humans that understand your issues and national security issues. Talk to us about how you view both the labor market for your industry and how the federal government can do a better job of recruiting smart people in the private sector who understand your world and can tie it to core national security issues?

James Litinsky:

Sure. Great question. Well, the good thing for us, by the way, is. . . I love saying this, but we have three major sites. We have a mine and a refinery, we have a corporate office, and we have the magnet factory. Our mine is in California, so we’re in a blue state. Our magnet factor is in Texas, so we’re in a red state. And then our corporate office is in Nevada, so I’d call that purple.

So, we run the gamut and we need people in all of them. What I would say is, realistically, it is easier recruiting in Texas, because we’re right in Fort Worth where there’s a lot of talent, than it is at Mountain Pass. It’s a 50-minute drive from the Vegas Strip, but it’s a long commute, so it tends to be a little harder. But we have engineers, operators, maintenance workers. It runs the gamut of what we really want to focus on. Good, well paying, middle class, blue collar type jobs. And we’re hiring. It’s really hard to find electricians. It’s really hard to find maintenance people. When you hear talk about getting the trades, getting more people in the trades, any policy towards that I think is well deserved because we have job openings for electricians in both places. And we’re paying a lot of money, and it’s just really hard to find people in a lot of those kinds of trades. Yeah.

Mike Gallagher:

Yeah. Well, we could spend the next hour talking about how to fix K through 12 education and bring back the trades, but you’ve interacted with members of Congress. You’ve interacted with people in the National Security Council. How do you think about the government being able to harness top-level talent in the private sector, whether it’s for DOD or whether it’s for commerce or treasury? It seems to me, I ask this, I think we make it a little bit hard for people that have unique expertise and who have been successful in private life to serve in government.

James Litinsky:

Yeah, well, I think that’s right. I’m frankly excited to see the new administration. Irrespective of your politics, the fact that you have Elon Musk and Vivek and all of these private actors. And I know some of these people, and I can tell you behind the scenes, there’s a lot of people in business who are. . . I myself texted a friend in that sphere, how can I help? There are a lot of people who want to help. And so it’ll be interesting to see what transpires over the next couple of years. It’s interesting. I saw this on TV the other day. One of the anchors was like, “Oh, well, Elon Musk is going to be focused on DOGE, the government efficiency, but is he really doing it to make money?” And I think the pendulum is probably way too far on the mindset of conflict.

Yes, there’s conflict when private actors go into government, but we have some big time problems. Let’s not lose sight of the forest through the trees or whatever expression you want to use. We need to think of this like a World War II war production board, or we have a lot of problems to fix. And if we screw up a couple of things on conflicts, okay, that’s a little annoying, but why don’t we do some major things for our country to get our supply chains back and really benefit from expertise to take government action to more of a state-of-the-art kind of situation?

And so I’m a big proponent of figuring out any ways we can get the private sector to really help out. And again, if it means that there’s some misses and conflicts, let’s not harp on that. That is a thing. We should not forget about it. But wow, if we can get all of this expertise and do great stuff for our country, and yeah, there’s going to be some downside to it, but I’d much rather have that than I would, “No, no, no, let’s keep business out,” and then find out we’re in just a strategic disaster.

Mike Gallagher:

Keep business out or continue government business as usual. As I often say, it’s time to make some original mistakes.

James Litinsky:

That’s a great way to say it.

Mike Gallagher:

That’s ultimately the American idea. We make original mistakes, then we correct. Okay, so robotics.

James Litinsky:

Yes,

Mike Gallagher:

Having solved various problems for us, how do we make sure we don’t lose the robotics supply chain?

James Litinsky:

So in robotics, I think what is strategically relevant that we’re talking about are humanoid robotics or other kinds of form factors that will operate in factories, but then drones or flying robots. And obviously, I don’t need to talk about the importance of drones with respect to national security as well as other expanded drones, eVTOL. And when we look across that board, magnetic content and supply chain are even more critical than in EV. And I don’t know if it’s some kind of Jones Act with respect to shipping or something where there is a holistic view of we need to have a supply chain for these industries from non-foreign entities of concern or allied nations or whatever the right nomenclature is so that this supply chain is forced from the beginning to develop. To develop and be broad.

We cannot lose this supply chain. And right now, I think was it 90 plus percent of the drones right now, you would know better than me, I know you focus on this, are made in China. Or the stuff for our military is made in China. Why wouldn’t we solve this problem now? Especially when right now it’s just an acute national security issue. As it becomes a bigger, broader commercial national security issue, it becomes virtually impossible to solve. But again, if we do it now, there’s a higher likelihood that we will have the downstream trillions of dollars of market cap here as opposed to dominating there.

Mike Gallagher:

The fix now, however painful, is far less painful than it’ll be the longer we delay.

James Litinsky:

And I will also say on that note, for example, with respect to EVs, in my supply chain, one of the things that often makes us collateral damage is there are very, frankly, powerful, big important companies further downstream that don’t want to deal with this issue. If you take the defense primes, they want to keep kicking the can with respect to supply chain requirements, and they throw up their hands and say, “Oh, we can’t do this. There’s no supply chain.” And so the discussion is very often around waivers.

Mike Gallagher:

Why is that in their interest to do that?

James Litinsky:

Because if they can get a waiver, they don’t have to solve the problem. And it’s very expensive. And take Lockheed or Raytheon, I don’t want to pick on a company, but take some product that they sell that’s a name-of-record product or whatever. They may have some magnet spec from 30 years ago that is frankly less efficient, less productive, not as good, versus something that we could make today. But to switch that out is very expensive and painstaking to them, and so there’s no incentive to do it. And so you have this inertia where it’s easier to seek waivers and just kick the can on this problem because the people who are incentivized to do it are not the people who are actually doing it. The people who need to buy these products have no incentive. And so I think also forcing that.

Government can be really effective in saying, “You’ve gotten waivers the last few times, no more.” Or, “Okay, if you want a waiver, you need to invest capital to help solve this problem.” Because I think, again, if you just look at the primes, there’s just been such inertia. And the common argument is, “Well, I can’t buy anything.” Well, yeah, you can’t buy anything because you haven’t tried. And so fine, if they get a waiver this time, it should be, “You’ll get the waiver, but we want to see you invest a billion dollars in X, Y, and Z,” or whatever. And again, those kinds of things can be worked out. But I think it’s a real problem. We will be in there advocating, as you know, if we’re in Congress or the executive branch or whatever, advocating.

But then if an Apple or a Raytheon or someone much more important than us goes in there, everything we said is like a sideshow compared to their issues. And frankly, as it should be. We’re not that important. But there needs to be a balance because those companies will have Chinese names in a decade or two if we’re not careful.

Mike Gallagher:

Okay. So taking a step back, one more big question before we get into audience questions. You started off as a hedge fund bro, and then now you find yourself a magnet baron, a national champion, but really at the forefront of a unique part of competition with China. What do you think you’ve learned about China or rather the Chinese Communist Party as a function of this phase of your career?

James Litinsky:

Sure. Well, first, I would say the biggest learning is building real stuff is hard. And it’s obvious, but when you actually go and do it, it’s even harder than you think. And it’s be careful what you wish for. I remember running my fund, I raised a lot of capital and it was very successful, and I did a great job for clients, and the rewards were great, but I always had a little guilt. I’d be like, “Oh, I move numbers on a screen and these rewards are enormous and I should go do something.” And then I guess I got my wish, and at least I still have my hair.

Mike Gallagher:

I move numbers on a screen. It’s really hard.

James Litinsky:

But it’s really hard and every day is a knife fight. What’s really frustrating, I think, in our space in particular is just. . . I guess what I’ve learned about the Chinese is they’re really tough to compete with. Some random software company or widget manufacturer is competing with another software company or widget manufacturer. We’re competing against the Chinese government, and that’s really depressing without help. We do feel a little bit like, “Hey, we need some air support.” And I’m being obviously very dramatic here, but we do feel like sometimes we’re special forces out there trying to get a job done, and we just have no air support. And it’s like, “Hey, we can only take fire for so long.”

And I do worry about that because when I look at the state of the industry today, we took this thing from a complete standstill. It was shut down. Not a single financial or strategic buyer shut up to buy this site. I was crazy enough to do this. And then I showed we can be successful. We produce four times the amount of product that the predecessor produced on an annualized, probably up to five times now on their best quarter annualized ever. We’ve shown it can be successful. We made a lot of money a couple of years ago. We’ve proven that this can work, but then the Chinese take the prices way down to where their companies lose money, and that can’t persist forever. We can’t survive forever, even if we’re lower cost than them. And so at some point, we need air support.

Mike Gallagher:

Okay. Quick lightning round, then we’ll get to audience questions. Beyond China or your industry, what other foreign policy or geopolitical issues do you find interesting or most care about right now?

James Litinsky:

Oh, sure. Well, obviously looking around the world, I care very much about what’s happening with respect to the two major theaters of war. And I am a big believer in Western civilization and the great Judeo-Christian values that have made free market capitalism, that have made America great. And so obviously I, on a personal level, taking my MP hat off, had a lot of concern with how the now outgoing administration operated policy, specifically in the Middle East and elsewhere, so I’m glad to see a real change in policy on that front ahead.

Mike Gallagher:

When you’re not running an incredibly important company, do you do anything fun? Do you read? Do you read fiction? Do you watch lowbrow TV?

James Litinsky:

I do. I read a lot and watch lowbrow TV and try to get exercise, so I’m pretty boring on that front, but-

Mike Gallagher:

Got it.

James Litinsky:

. . . I like to share good book ideas with you.

Mike Gallagher:

Yeah, I need to steal some from you. I’m embarrassed to admit some weird sci-fi books I’m reading right now.

James Litinsky:

I don’t have a recommendation for you yet, but I’ve got a few. I’m trying to do some research on how the private sector interacted with government in the forties and fifties, because I think that that is a very imperfect analogy, but a case study for, particularly given this new administration, how can that relationship work well? What are the pitfalls, maybe? You’ve probably read all those books.

Mike Gallagher:

Tuxedo Park is a book I would recommend to you on that. And finally, favorite former or current member of Congress? You don’t have to answer that. Okay. Audience question.

James Litinsky:

He’s on the stage.

Mike Gallagher:

Yeah, exactly. Exactly. Sure. Tom. Yeah.

Tom Duesterberg:

Tom Duesterberg here at Hudson. First, thanks for doing what you’re doing. I think it’s heroic and I wish you the best.

James Litinsky:

Thank you. That’s very nice.

Tom Duesterberg:

Rare earths are, as far as I remember, 17 separate metals.

James Litinsky:

Yes.

Tom Duesterberg:

Do you do all of them? Because some metals go into lasers, semiconductors, and so on and so forth. Did you do the whole gamut?

James Litinsky:

Almost all of them. The short answer is, the reality is there are only a handful that are really relevant. NdPr, or technically it’s PrNd, neodymium praseodymium, and then dysprosium and terbium, those are the key four for magnetics. The last two I mentioned, dysprosium and terbium, are the heavies. Sometimes you hear of heavies. A lot of them come out of Myanmar through China. Those are the four key ones. And then there’s various other ones that are niche use cases, but 90 plus percent of our revenue as a business is NdPr-related, so neodymium praseodymium.

Mike Gallagher:

And those playing our drinking game at home, watching, having just heard-

James Litinsky:

It took me three years to properly pronounce that.

Mike Gallagher:

Take a shot.

James Litinsky:

That’s right.

Mike Gallagher:

Sir.

Artem Gergun:

Hi, my name is Artem Gergun, Wilson Center. Originally I’m from Ukraine, and we are making very good neodymium magnets for certain in Switzerland, in Kharkiv actually, which was bombed quite heavily recently. So my question is, isolationism is a good foreign policy for US in that regard? Thank you. What’s your opinion?

Mike Gallagher:

My short answer is no, but I’m happy to elucidate. Yeah.

James Litinsky:

Sorry, is the question-

Mike Gallagher:

Is isolationism a good policy for the United States, correct? Yeah.

James Litinsky:

With respect to our industry or writ large, or-

Artem Gergun:

With respect to Ukraine and US national relations.

Mike Gallagher:

Easy one. Easy one.

James Litinsky:

Yeah. Oh, its’ an easy one. Well, so I think the Ukraine War and what’s going on in the Middle East are obviously two different theaters that require two different reality understandings. And I think I am always surprised at some of the traditional national security that says, “We must win at all costs in Ukraine, but we must have a deal for a two-state solution in the Middle East.” And I think it’s somewhat the opposite, which is we obviously have to defeat the idea of political Islamism. That is just in conflict with our values, always will be, and the two things cannot coexist over the long term. Whereas realistically in Ukraine, whether we like it or not, Russia is a nuclear power. I’ve never spoken to him, but I’m sure if you asked Putin and you offered him the choice of losing or nuclear war, he may very well choose nuclear war.

And so I think that is a scenario where there’s ultimately going to be some kind of deal where they’ve made territorial gains. There will be some deal cut. I’m certainly not privy to enough knowledge to know what’s the bid ask and how all of that works. But to have hundreds of thousands into the millions of people continue to die, to end up at the place where it’s either a deal or nuclear war, why don’t we just not have the killing now and come to a deal? And again, I don’t know how you get to that deal. I’m not a State Department expert, but we should get to that deal as quickly as possible. Whereas I would be inclined, with respect to fighting Hamas, Hezbollah, the arms of the Iranian terror proxies, that we would take a much longer-term approach where there is no deal. We can’t coexist with that kind of attitude towards civilization. And so, I don’t know if that answers your question, but that’s how I view it.

Mike Gallagher:

Yeah, can I add a little spin too? I’ve always thought, yes, isolation is a bad policy, a bad sort of intellectual foundation for US foreign policy because problems don’t age well and Las Vegas rules don’t apply often on the world stage. What happens in places like Taiwan and Ukraine won’t stay there.

However, the isolationist impulse, which is not new and is very deeply ingrained in American history and society is in some ways a healthy impulse. I think it keeps us, those of us who believe in a robust forward-leaning forward, deployed deterrent, it keeps us honest, right? Because you need to pair that internationalist position with prudence and a sense of prioritization. So I don’t know if that makes any sense at all. This is not my panel. I should talk less.

Yes, sir. There and then there. Yep. Yep.

William Chou:

Her or me?

Mike Gallagher:

You and then her. Yeah, sorry.

William Chou:

Hi, William Chou here with the Hudson Institute. I sort of want to follow up on his question, but focusing more on your industry. What do you think should be the role of allies on the critical, sorry, rare earth’s space?

I primarily work on Japan, so there’s a very well-documented case of Japan supporting the Australian firm Lynas during 2010s, which has paid off. So I guess going forward, what scope is there for working closely with our close allies on rare earths? Is it through finance? Is it through a wider proliferation of what you propose of this public-private partnership in insuring prices? What forms should this kind of partnership take?

James Litinsky:

Great question. I think certainly with respect to this space, the great thing about a mine refinery or manufacturing is you can’t pick it up and move it to Beijing. So if it exists, certainly any of these assets in Australia, Five Eyes nation, a true ally, like great. So we should absolutely incorporate for sure Five Eyes and then beyond any kind of reasonable ally should be sort of under that same umbrella of getting this supply chain online. And there are obviously places that have added benefits. Certainly Australia and Canada are very effective jurisdictions that appreciate mining.

I’d be a little bit more hesitant with respect to certain . . . Africa is a very powerful mining area, but obviously the Chinese influence there is very significant. I think whatever we do, we have to balance though, when it comes to public private partnership and capital, we have to balance getting the supply chain with just the concept of how far out do we want American dollars to help frankly, workers in other areas.

And that’s more of a political decision. Like if the United States government, what I’ve dubbed the Federal Critical Minerals Insurance Corporation, if Canada was a qualified jurisdiction, fantastic, Australia, fantastic. If it was South Africa, that could be challenging. And so I think that that’s sort of more of a political decision, but we should absolutely incorporate them.

And then another thing, this kind of raises an issue that is something that we’ve said to government, and I think about it with respect to Africa, but I think it goes with South America as well. But one of the challenges with, I know the DFC, for example, has been wanting to hand out capital is the FCPA. Certainly an American company business practices cannot compete with, say, the Chinese government in Brazil or somewhere else-

Mike Gallagher:

Foreign Corrupt Practices Act.

James Litinsky:

Yes, Foreign Corrupt Practices Act. And so I think we need to think about those concerns. And then we also should be a little bit skeptical of jurisdictions that go beyond sort of our traditional, very tight Five Eyes type allies when we go into certain areas of South America or Africa, because obviously you can have sort of significant government intervention that can destroy the value of assets or expropriation or whatnot. And so we obviously don’t want to risk the same amount of capital in places like that versus true allies if we can.

Mike Gallagher:

Yes ma’am.

Daniella Cheslow:

Hi. I am Daniella Cheslow, Deputy Tech Editor at Politico. I wondered from both of you, how should the US navigate the presence of American tech companies in China? I’m thinking about Apple, which just announced a new lab in Shenzhen, or of course Tesla and its Gigafactory. Can these companies continue to manufacture in China in this increasingly rivalry hostile environment?

James Litinsky:

You want to do that first one?

Mike Gallagher:

Yeah, yeah, yeah. Yeah, I’ve made the case to many of these companies that my view is this trend of decoupling is going to continue. It is going to continue to be hard to do business in China. And particularly if you believe my other hypothesis that the risks of a near term competition over Taiwan are going up, not down until we fix the conventional balance of hard power. Just for pure economic reasons, now is the time to start getting out of China.

Now, I recognize, and one thing I think I learned in chairing the Select Committee on China, that that is not an easy thing to do. I mean, if you’re Apple and you’ve spent the last two and a half decades building exquisite manufacturing facilities in China, it’s not like we can fly a helicopter, pick all those factories up and put them in Vietnam or Indonesia the next day.

So I get that it is going to take time, but now is the time to start. And I think in a variety of industries, how much more evidence do we need to recognize the game that’s being played here? It’s like they invite these companies in. They make it very easy. It’s cheap to produce stuff, and then they steal all your intellectual property and they prop up their own domestic indigenous industry and then fight on an unlevel playing field.

So that has played out in a variety of different industries. It’s playing out even in the entertainment industry right now. And I think the sooner . . . And by the way, how much more evidence do we need to suggest that the entire hypothesis of the more business we have in China, the better our political relationship will be and the more freedom there will be in China. That was a bet both parties made a long time ago. It failed. It failed spectacularly. So let us not double, triple, quadruple down on that same bet. Not that I have strong feelings about this, but. Yeah.

James Litinsky:

Well, I would just add onto that, of course, every industry is somewhat different. And I think to the analogy you just gave, Apple is further down on that sort of maturity level of where you’ve seen sort of intellectual property expropriation and now a competing industry take in shape and they’re being pushed out.

Tesla is obviously an outstanding producer. With auto production it’s logical to think that globally auto production is somewhat of a state run industry in the sense that local production makes sense for that jurisdiction. And so I think we should applaud Tesla producing cars in China for the Chinese. I think that that’s great competition and we should welcome that. And we want our companies to compete in China and do well.

I think it gets a little bit more challenging if Tesla becomes, which they are now, but a very large exporter from China where they’re getting the benefits of sort mercantilist policy and then utilizing that to have Chinese production dominate elsewhere in the global south or in Europe.

What I would say is obviously this is a vexing problem, but every industry is different. And we shouldn’t necessarily say completely leave. We need to compete and exist in a world with China as a major competitor, and they’re a very tough competitor and we should try to find success there.

But we also need to recognize that I think depending on the company, there’s been a lot of short-term thinking, and I’m not touching whether that those two are it. But it’s very hard to get a CEO to think about the ramifications of a decade from now of not shoring up your supply chain.

And so I do think that that’s the place of government, is to force these externalities that exist on our economy onto these companies so there is a sense of urgency. Because if you’re the CEO of a major company producing in China, it’s tough to miss your quarter over something and lose your bonus versus make a long-term decision that is for the benefit of the United States of America that may cost your shareholder something. The government should provide cover for that. The government should help companies make those tough trade-offs and I don’t think we’ve done enough on that front.

Mike Gallagher:

Okay, two more here and here. In two minutes we can do it. Yep.

Tom Duesterberg:

Name’s Nii Simmons. I’m sorry. My is Nii Simmons. I’m ex-nonresident fellow at Atlanta Council Center for Global Development. I used to work at the World Bank Group, so a lot of my work is in Africa, a little bit of Southeast Asia. I’m first generation Ghanaian American. Both of my parents are from Ghana. One of the things that I’ve noticed as I talk to certain African heads of state and the ministers, one thing they’re looking at is how do they focus the value addition?

African countries now have moratoriums where they’re not allowing unprocessed critical minerals to leave. And then you have, and I’ve written quite a bit around critical minerals, semiconductors, and there’s a few people who’ve seen what I’ve written from DoD and they said, “We were concerned about the coups in Africa. How do we secure some of these critical minerals because we’re worried about Russia, China and that sort of thing.”

Question to you is, what are your thoughts on that? And you kind of addressed this before. Obviously FCP makes a . . . I mean, you don’t want Justice Department knocking on your door and say, “Hey, what did you do a couple years ago?” So in the era of strategic competition, in your thoughts, how do you partner with African countries to develop a partnership that it’s win-win? ‘Cause this whole China plus one strategy, Africa is not in the conversation.

James Litinsky:

It’s an excellent question, and I touched on it before because it’s very topical in the sense that I can think of a couple projects in Africa, for example, that would make a lot of sense. And when we look at and would be great for supply in the world, it would be great for allied supply. But when we look at projects along with that consideration, aside from sort of the general things you would expect, like economics are, okay, well the government wants a very high royalty rate. Will this government be around? How politically stable is this and expropriation risk?

And sadly, the short answer is it depends on the country, but especially with respect to critical minerals where these are very long-term projects, they require a lot of capital. And you’re talking about 5, 10 years, more likely 10 to get something online. And then the economics makes sense over the next couple decades.

And so to do an out, it’s hard enough to know what our political situation is in the US, let alone Africa a couple decades out. And so that is the challenge with respect to those, and frankly, why it’s much harder as an American company to do business there vis-a-vis, say a China for example, that can frankly have much more extreme methods in how they’re dealing with the government and other entities in the country.

And so that would be on the list of things to think about is kind of how we can help. And I mentioned the FCPA, but in thinking about sort of general expropriation risk, and maybe it’s tied into this insurance concept. But that is a key question and consideration that’s part of this whole issue around critical minerals.

Mike Gallagher:

Last question.

Julie Millsap:

Hi. I’m Julie Millsap. I’m with an organization called No Business with Genocide, a really subtle title there with a background in Uyghur human rights advocacy. So I’m wondering if you could just touch a bit on what role the effective instrumentalization of human rights messaging plays in your thinking of trying to get actors and partners to prioritize securing those particular rights.

James Litinsky:

Well, it’s nice to see here, and I think it’s great because certainly when we think about the challenges globally and where there are people that are oppressed and whatnot, there obviously, at least on our college campuses, tends to be an overly focused on one specific group and ignore the gender apartheid happening to many people around the world in many countries and certainly in the Uyghur situation.

With respect to rare earths it’s not something that we see a lot as an issue because it’s much more of a downstream product issue. And so when I think about the mines refining and magnets, we don’t see that. The bigger issue that we see is that there is quite a bit of rare supply that comes in from Myanmar. So there’s a border region, the country’s kind of dominated by a military junta, but the opposition party has kind of taken over a chunk of that area. And frankly, the mining that they do there is very environmentally destructive. They’ll do, for example, they’ll just kind of pour acid on a rock to get stuff and send it to China, and it’s just a total disaster for the people there. And so that needs to get cleaned up.

So we tend to see that issue as sort of something that gets discussed and talked about. But I guess fortunately or unfortunately for our space, it doesn’t necessarily touch the Uyghur issue as much just because we’re not there.

Mike Gallagher:

Ladies and gentlemen, a private sector leader and a true patriot, Jim Litinksy.

James Litinsky:

Thank you. Thank you.

Mike Gallagher:

Thank you. Awesome. That was great. Awesome. It was great. Perfect.

James Litinsky:

It was fun.

Mike Gallagher:

Perfect. Perfect. Perfect. Cool.

James Litinsky:

Thank you everyone.

Mike Gallagher:

Great.

Major General Mark Mitchum will discuss the Air Force’s nascent Integrated Capabilities Command.

Join Hudson Institute for an event with Norwegian Finance Minister Jens Stoltenberg.

Join Hudson for a conversation between Indian Finance Secretary Ajay Seth and Distinguished Fellow Walter Russell Mead.

Hudson Institute’s Center on Europe and Eurasia will host its third Central and Eastern Europe (CEE) Strategy Summit.