An Integrated Approach to US-Japan Cooperation with Southeast Asia

Professor of Policy Management, Keio University

Managing Director, J.P. Morgan Commodities

Director, JETRO NY

Fellow, Center for Defense Concepts and Technology

David Byrd is a fellow with Hudson Institute's Center for Defense Concepts and Technology.

Deputy Director, Japan Chair

William Chou is deputy director of Hudson Institute's Japan Chair.

Japan Chair

Kenneth R. Weinstein is the Japan Chair at Hudson Institute.

Southeast Asia is increasingly important to both Japan and the United States thanks to the region’s economic growth and proximity to key shipping lanes and geopolitical flashpoints. As such, in April 2024 the US, Japan, and the Philippines signed a trilateral agreement to expand investments and maritime security initiatives. Future US and Japanese engagement in Southeast Asia should adopt a similar approach to address growing security and economic concerns in the region.

Hudson’s Japan Chair will welcome a panel of geopolitical, security, and economic experts to address the challenges and opportunities for US-Japan cooperation with Southeast Asia. Hudson Japan Chair Kenneth R. Weinstein will moderate a panel discussion on how the new administrations in Washington and Tokyo can work to address these interrelated issues.

Event Transcript

This transcription is automatically generated and edited lightly for accuracy. Please excuse any errors.

Kenneth R. Weinstein:

Good morning and welcome to Hudson Institute. I’m Ken Weinstein, Japan chair at Hudson, and I am delighted to welcome everyone who came out for this event on US and Japan cooperation on Southeast Asia. Came out on this, what we consider a very snowy day here in Washington. I don’t remember this as being a snowy day for my days in Chicago or Boston, but so be it. But delighted that we have such a crowd and we have such a distinguished panel with us here this morning.

On behalf of my Japan chair colleague, deputy director Will Chou, I want to just thank Will and thank the Hudson Institute events team for pulling this event together. Southeast Asia is obviously increasingly important to the United States, thanks to the region’s demographic growth and its proximity to key shipping lanes and geopolitical flashpoints. We obviously saw April 2024, the United States, Japan, and the Philippines signing a trilateral agreement to expand investments in maritime security initiatives.

This initiative was reaffirmed in the Trump-Ishiba Summit last week, the historic meeting at the White House on Friday, and the notion that future US and Japanese engagement in Southeast Asia might adopt a similar approach to address growing security and economic concerns in the region is something we’re looking at today. We’re delighted to have very distinguished geopolitical security and economic experts here with us this morning, and I will introduce them first by name and then before each of them speaks.

To my immediate left is Ken Jimbo, who is a professor of the faculty of public management at Keio University and managing director of programs at International House Japan. To his left is David Byrd, my Hudson Institute colleague who was with our Center for Defense Concepts and Technology. Next to him is Yuki Shimazu, who is a special advisor for Japan’s Ministry of Economic Trade and Industry METI and Director of Industrial Research at JETRO, New York.

And lastly is Kenan Arkan, who is a managing director in Commodities Origination at J.P. Morgan. And so let me welcome each of you and let me just ask each of our panelists to open up the session with some opening remarks. I should note that Ken Jimbo’s work focuses on international security Japan-US security relations, multilateral security in the Asia-Pacific, and he is published in just about every major Japanese publication and has been a policy advisor to numerous Japanese governmental commissions. Really needs no introduction to anyone who does work on Japan. So it’s an honor and a pleasure to welcome you, Ken.

Ken Jimbo:

Well, thank you very much, Dr. Weinstein. And I’d like to begin by thanking the Hudson Institute for organizing this fascinating event, especially immediately after the summit meeting. I thought it was a tremendous success to reconfirm the importance of the Indo-Pacific and also to focus on Southeast Asia. So this is, I think, a timely topic to be explored.

And I think Indo-Pacific has become an increasingly contested region as Dr. Weinstein has just laid out with the intensified geopolitical competition, rising economic security paradigms throughout every economic and business relationship that they are interacting with each other and the shifting balance of influence over the region.

And Southeast Asia as you are all well aware, it has been the region that was traditionally tried to be remote from great power rivalry, but now has become the pivotal place for the strategic competition. But at the outset, I would like to remind that ASEAN’s strategic orientation seems to be shifting and that is not necessarily in Washington’s favor.

And as it was often cited for the first time, the majority of the Southeast Asia elites prefer alignment with China over United States if forced to choose between the two. This is according to the ISIS famous survey that took place last year. And while I believe the United States remain to be commands strong support in the Philippines, Vietnam, and Singapore, but it has seemingly losing the ground in Indonesia, Malaysia, Thailand, and Laos. And I believe this trend should never be underestimated. And if ASEAN tends to tilt towards China or the emerging economies or the BRICS plus types of the alignments, the US and Japan would face significant constraints in shaping our future regional strategies.

So with this calibration in mind, I’d like to reiterate three key areas that Washington and Tokyo needs to highlight. And number one is that we should encourage strengthening of the ASEAN’s strategic autonomy rather than asking them to choose the sites. That’s number one. And the second is to recalibrate the security engagement to match ASEAN’s strategic realities. And number three is delivering economic alternatives that caters and try to counter China’s growing economic influence in the region. I’ll try to be brief, one by one.

On the strategic autonomy has been the ASEAN’s key principle for long years, but that has been challenged by so many aspects, obviously through China’s expanding economic, military and digital influences. And secondly, ASEAN also experience its own internal divide. And the third has been the erosion of the ASEAN’s security consensus, mostly demonstrated in the South China Sea. And also there has been a delaying process of the consolidation of the ASEAN’s collective strengths because of incapacity to solve the issue in Myanmar.

And the second I think that the common I think terminology often cited is ASEAN prefers to not to choose the site, but I think that the real challenge is to how to develop ASEAN, which is powerful and resilient enough that can deny choosing the sites. And in that context, I think that the basic fundamental strengths of the ASEAN is I think the focus that we need to pay attention. In that stance, we probably needs to pursue more pragmatic and no coercive approaches, and that should be the key in US-Japan engagement in the region.

And to be more detailed, and the second part is the security engagement. ASEAN seems to prioritize the flexible alignments, rather than asking for the formal coalition in the most aspects of the security orientation, they are now choosing as Dr. Weinstein has mentioned, that expanding of the minilateral security partnership provides some kind of prototype that how we can engage ASEAN in a much more conducive manner. For example, in the Philippines, they definitely need to ask for the United States’ security guarantee based on the Article IV of the treaty. But at the same time in the detail, they have to have a layered security buildup in every spectrum of the escalation management they need to do, starting from the maritime security concerns, law enforcement. And that has to be covered by the Japanese provision of the Coast Guard vessels, capacity processing capability in dealing with that.

And then in advance of that, they also need to have a security infrastructure like the EDCA sites that the United States are prone to have a better access in the nine infrastructure sites in the Philippines. And that can be, I think, coordinated through the financial engagement by Japan and Australia. And that could be the key in how the minilateralism can really converge the interest of the security concern. And I think that this is the way how really you can really reach out to the ASEAN member states beyond the Philippines as well. And definitely we need to have a better crisis and de-escalation management mechanism in South China Sea, and I think East China Sea maritime and air communication mechanisms and how we can really approach to the crisis management mechanisms should also be referred in both seas in the East Asia.

And also broadening the security assistance beyond the defense domain is also could be the key that we can really promote further and the Japanese provision of the official security assistance. And that has been in the trend of the growing in terms of the size of the finance and that should also be aligned with how United States tried to approach to Southeast Asia.

And finally, I’ll finish by talking about US-Japan economic cooperation, I think, which will be, I think covered by the rest of the panelists here. But definitely we’d like to point on the importance of the supply chain resilience and also the digital economy sovereignty issues, and also the green energy investment and also through the promotion of the promoting of the energy efficiency in the region. So my key message today is that we are not try to advise ASEAN to balance China, but to engage ASEAN to empower itself. And so the overall objective is to create the Indo-Pacific where ASEAN actively choose to engage from their front. I’ll finish here.

Kenneth R. Weinstein:

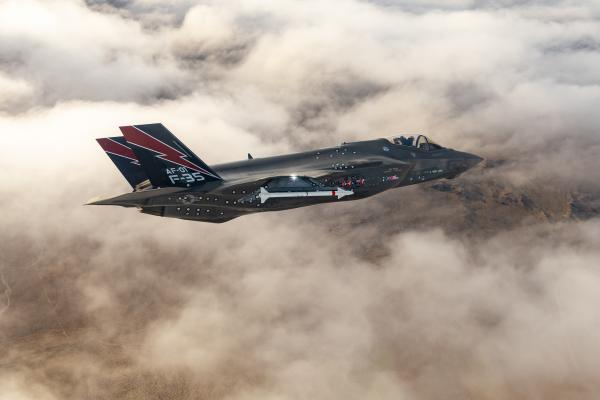

Great. Okay. Very thoughtful and well-organized presentation, and thank you for the focus on trying to engage ASEAN to empower itself. Now have the pleasure to turn over to David Byrd, who as I mentioned before is a fellow with our Center for Defense Concepts and Technology. He works on future concept development, data analytics, and the application of artificial intelligence to military problems.

He has done this work both at the Pentagon and at Lockheed Martin before where he’s developed war games and focuses on the technology of the future, AI, autonomy, manned, unmanned, machine teaming and the like. And David is sitting in today for Brian Clark who had a unfortunately a personal engagement he had to take care of. So over to you David, thank you for being with us on such short notice.

David Byrd:

Absolutely. Thank you, Ken. So as Ken mentioned, I’m coming at this from the Center for Defense Concepts and Technology, and we really approach this problem through an operational lens of what it means to engage in a potential conflict with China and really examining the constraints of deterrence.

So the hard truth of it is, the US is facing a pretty unfavorable balance of capability when compared to the PLA in the Indo-Pacific. They’ve got more ships, they’ve got more planes, they’ve got more missiles, they’ve got basically more of everything. And technologically they are at the very least a peer competitor and potentially stronger in certain areas. So the classical conception of the concentrated application of US forces to achieve deterrence by denial is no longer tenable proposition. However, and the US really can’t build enough to change that balance simply because of the fact that the US is a global force and everything we build has to kind of go everywhere in the world. Meanwhile, China tends to fight in its own backyard.

But this balance becomes much more favorable when you look at it in the broader context of the potential partners that the US has in the Indo-Pacific, not in the Southeast Asian countries, China, but also Australia and New Zealand. These forces together actually give us a fairly balanced capability matchup against the PLA. The real challenge in this, though, is coordinating those forces effectively and being able to operate together with intent in an operationally relevant amount of time.

And China understands this. A major part of PLA doctrine is not just winning tactical engagements or operational objectives, but controlling the escalation of a conflict. That includes both the escalation in intensity, but also placing great emphasis on controlling the time and space escalation and controlling the participants involved. So China’s main objective is to try and isolate individual countries and conduct one-on-one engagements with more favorable force balances and prevent the effective coordination with the United States.

So it really comes down to how do we do this effectively? Even if it’s the only path forward, if we can’t actually do this coordination, then that approach to security and that approach to deterrence will fail. We can see historical examples of this in the failure of Plan B and the opening hours of World War II. Belgian, British and French forces weren’t able to coordinate effectively to establish a defensive line. Germans were able to break through, and this eventually led to the fall of France and their operational concept and their political coordination wasn’t fast enough and flexible enough to deal with that kind of warfare.

So from our perspective, we really look at this beyond the political and strategic agreements necessary to enable this kind of cooperation. But what does it mean to develop the material integration between forces of the US and its partner nations? So you can consider something of how do we develop forces that are aligned by design so that there’s the minimal amount of friction when a decision is made to actually supplying forces to partners, coordinating with forces of partners, handing off intelligence command and control all of the things that you need to do to make modern warfare effective.

And so we look at this from the perspective of force design. Something that our center really believes in as the future is the relevance of uncrewed systems as a hedge against the most pressing and difficult problems that any individual force might face. And the advantage of focusing on this kind of technology is it’s very customizable. You don’t have to have a large, expensive multifunction system that does everything or does everything somewhat poorly. Each force can design the capabilities it needs for its own geography, its own political and military objectives, and its own resource constraints.

So you can see the beginnings of this kind of cooperation through efforts such as AUKUS Pillar Two, and Japan has begun engaging in that. And that achieves two real objectives. One, the US and these partner countries are beginning to think about force design in a coalitional fashion. So we’re able to design systems that are interoperable with each other, and two, from an industrial-based perspective, we’re able to diversify and increase the scale of production of these forces so that we can match pace with the threat.

And this is two advantages. One, it overall increases capacity and increases the diversity and security of that production base, but two, it also enables a much more rapid integration of forces in the event of a crisis because they’ve kind of been built to be integrated from the ground up. You can see this not working in a place like Ukraine where most of Ukraine’s historical forces are old Soviet equipment that they’ve trained on, which is great for salvaging things from the battlefield, but when we tried to bring in new tanks, aircraft, new systems that are very effective against Russian forces, there’s a major delay in actually integrating those forces and bringing them to the battlefield because you had to redo all the logistics. You had to set up specialized maintenance and supply and sustainment facilities and you had to do a lot of training for Ukrainian troops to just be able to use these things.

So thinking about what it actually takes to get a system to the battlefield and fighting isn’t just a command decision from a local commander, and it’s not just a question of some US defense contractor making the thing. There is an entire industrial and organizational process that goes into actually building this into a coalitional fight that we still haven’t fully developed, but I think is going to be the main focus of how to effectively execute these kinds of these security agreements that we hope to develop with these partner nations. So I think I’ll leave it there.

Kenneth R. Weinstein:

Great. Thank you, David. Very informative, very interesting. Slightly different take from Professor Jimbo. And now I have the pleasure of welcoming Yuki Shimazu who as I mentioned earlier, special advisor for Japan’s Ministry of Economic Trade and Industry, METI, and he’s also director of industrial research at the Japanese external trade relations organization in New York. He advises the METI ministry on energy and climate policy, and his work in the past has included renewable and nuclear energy policy, which nuclear in particular is becoming much more important for Japan, as is renewable, promoting foreign direct investment. And we heard about the trillion dollars in FDI heading our way graciously from Prime Minister Ishiba’s pockets and that of Japanese private industry and boosting private sector human capital investment. He’s a graduate of both the University of Tokyo and he did his MBA at the Sloan School at MIT. So welcome, Yuki.

Yuki Shimazu:

Thank you. Hello, everyone. My name is Yuki Shimazu. First of all, congratulations to Dr. Weinstein and William Chou and the teams in Hudson Institute on hosting this event today, even though it is the weather like this, but so I’m very much honored to be able to participate in this role. Today’s event theme is very timely, I think. How should Japan and the US be involved in Southeast Asia in the face of rising geopolitical risks, or should we need even more integrated perspectives than we have now? Those questions, it could be definitely big issues to be discussed, I think.

And in US in Japan, new administrations have only been in power for a short time, a few weeks or for several months, respectively. And last week we saw a very positive atmosphere during the Japanese Prime Minister and the President of the United States had a meeting in this context. I am looking forward to discussing various possibilities with you today, and I’m presenting a little bit this way.

So now I’d like to talk about energy policy. Japan has three principles. The first is three breakthroughs. We must always pursue economic security, sorry, economic growth, emission reduction, and energy security at the same time. That means we’ll not sacrifice the one for the others. And the second is diverse path for each countries. So it’s like this, we value the circumstances of each country, even if the ultimate goal of a country is to achieve carbon-neutral in 2050, the method used to achieve carbon neutrality. That goal should not be limited to 100 percent renewable energy, for example, but should allow for a combination of various technologies.

And third is solving global issues. I’m sorry, let’s go back. Oh, yes. So the third, I’m going to explain the third part that solving global issues, our GHG emissions count for 3 percent of world total, but will contribute to reducing global emissions by providing our technologies and know-how to the world.

With this in mind, let’s take a look at the power generation mix in Southeast Asia. Sorry, it’s this one. So in the pie chart, the red bordered section represents the ratio of power generation using fossil fuels. Of these, brown section represents coal. So you can see that there are still countries where the ratio of coal use is high. On the other hand, many of these countries have also set carbon-neutral targets like this. Probably you can see it will be very difficult to reduce the red bordered area to zero in the next 20 to 30 years.

So these countries also must achieve carbon neutrality, but at the same time, they have to avoid inadvertent surge in electricity prices because they have a high proportion of manufacturing industry within their industrial structure. Then with them, the initiative we have been working on is yes, Asia General Emission Community. This is a concept proposed by Japan in 2022, and it is a platform for Asian countries to cooperate in order to achieve decarbonization economic growth and energy security at the same time. It emphasizes combination of diverse energy sources and diverse technologies rather than specific energy sources, as I said, and nine south Asian countries and Australia have joined, making a community of 11 countries, including Japan.

Summit meetings and the ministerial meetings are held in ‘23 and ‘24. In conjunction with these meetings, we are working to accelerating their formation and the development of the business cooperation and the private sector. And the next page is a map. So this page shows the participating countries on the map. So if you are really keen to today’s events team, some of you might be tempted to consider the geopolitical implications from this map. But I’d like to emphasize here that we are now implementing this airport for our energy policy, and this is a picture.

So this is a commemorative photo from the most recent summit meeting, which was held in Laos last October. The person standing in the center is the Prime Minister of Japan Ishiba, and I like to introduce the latest results of ASIC as well. In ‘23, more than 350 energy cooperation projects were announced collectively. In ‘24, the formation more than 120 MOUs and other corporation projects was reported. I’d like to emphasize that these projects include not only renewable energy but also ammonia, CCUS, power grid, LNG, et cetera. Actually, Japanese companies from a wide range of industries are participating in the projects.

In addition, many of Japanese government-affiliated support organizations have expressed their support including JBIC, JETRO, JAICA, JOGMEG, NIDAL, and NEXI. At the summit meeting last October, we also established an action plan for the next 10 years.

So what about Japan-US corporations? Of course there have been a number of Japan-US cooperation projects in Southeast Asia so far. For example, 2017, which was Trump’s first term, there was a bilateral energy cooperation framework, which is called JUSEP. Under this framework, there was a three-country LNG forum that included Southeast Asian country.

We also had a Japan-US energy security dialogue. Through this dialogue, we did discussions on CCS, carbon recycling and SMRs critical minerals and LNG, and we also agreed on the need for the cooperation for clean energy development in the Indo-Pacific region. We also had a Japan-US-Philippines summit meeting last year as Dr. Weinstein said, and we agreed upon our cooperation on civilian nuclear power and critical minerals.

So that’s all from me, but so today’s question, now we are just beginning to discuss the way in which Japan and US would cooperate in the future. We at METI hope to start discussion with US government from now as well as the US and Japan industry side as well, but I’ll also be grateful for any valuable advice from you today. That’s all from me. Thank you very much.

Kenneth R. Weinstein:

Thank you very much. Shimazu-San, very informative. Lastly, we get to hear from Kenan Arkan who I think is the only Division I varsity football player on this panel. I know I did not do that. He played at Vanderbilt where he earned his B.A. and his M.B.A, but more importantly for our purposes, he is, as I noted before, managing director in commodity origination at J.P. Morgan, and he leads the development of the physical energy and global LNG business. Before joining J.P. Morgan, he spent two decades at Goldman Sachs in various leadership roles across natural gas, power, LNG, and public sector businesses, and has broad experience with multinational corporation, public sector entities and governments around the world. He’s both briefed and partnered with. So I want to thank you for joining us and look forward to your presentation. Thank you.

Kenan Arkan:

Thank you. Can never escape the old football career. Well, good morning. I want to thank obviously the Hudson Institute for having me and fellow panelists as well. A reminder that I have to give, I have some colleagues in the room. My views do not reflect those of J.P. Morgan or its employees. This is me as a personal individual.

Obviously a critical topic. I’m going to focus on things from a financial institution and a commodity trader perspective. I only have six minutes per Will, and so I’m going to heavily focus on LNG. There’s obviously sustainability. There’s a supply chain dynamic, which I’m happy to talk about separately, but just want to be clear that LNG is going to be my focus and frankly where I spend the majority of my time.

So obviously as highlighted, the energy opportunity in Southeast Asia is vast. Just looking at statistics, bridging the gap in three nations, Philippines, Vietnam, and Thailand would require a doubling of global wind and solar as it stands right now and 25 percent of global natural gas supply. This is primary energy consumption. If you add in Indonesia and Malaysia, you double that to get to OECD per capita levels.

From a sustainability perspective, as highlighted, a lot of these countries use coal, so that’s an important dynamic when you think about LNG and what it displaces. And really what’s stopping investment or limiting investment flowing from a financial institution perspective is certainty, which is a point I’m going to keep coming back to. Obviously, US-Japan cooperation in energy can bridge this gap. The US is a world leader in energy exports, production and production, which is enabled by geology infrastructure innovation. Japan is obviously a leader in LNG investing, operating, as well as being a trader and a marketer and a supplier to the world. It also has played a leading role in expanding energy infrastructure in Southeast Asia.

The opportunity to obviously fully align these strengths within the region and turning this opportunity into investment or into reality requires investment. LNG projects, however, do not get built without financing certainty, and I would say LNG financing is not about geopolitics, it’s about credit and execution risk. Again, from a financial institution perspective. Investors need certainty that long-term contracts are going to hold and governments can help provide that certainty.

Even with what’s occurred with LNG export policy uncertainty from the US, the key challenge remains, which is executing long-term binding contracts that support long-term financing and large-scale financing. Generally, these projects are in the $5 to $15 billion range each. Southeast Asian buyers specifically generally lack the credit rating to support these long-term agreements. And so for financial institutions, this means not only the regulatory uncertainty we’ve talked about, but also high counterparty risk when you think about financing a project backed by less creditworthy counterparties.

Without bankable offtake contracts, LNG projects do not happen and they stall. So government-backed support in a variety of forms can bridge this gap. It’s important to note that the US transitioned from an LNG importer to the largest exporter of LNG using this project finance model, and this model also created the most flexible LNG contracts in the world. US contracts specifically lack destination restrictions like the Qatari contracts, which make them more attractive for a trader to have the option to redirect their cargos elsewhere if domestic demand doesn’t call for it.

Additionally, US LNG can be supported by robust financial risk management tools and integrated with upstream and midstream investments, obviously, which Japan is a leader in the US. To this also Japan brings best-in-class supply and trading infrastructure, which is really important when you think about long-term LNG viability given, we will call it evolving domestic demand in Japan and the needs of Southeast Asia.

So right now, prior to last week’s meeting between the two administrations, only 8 percent of Japanese LNG imports come from the US. However, existing investment and trade frameworks are deep meaning there’s room for a lot more growth. For both countries, the opportunity is to provide energy and infrastructure to Southeast Asia, which is a compelling offering and one being made right now by competitor nations in the region.

So if the private sector has the tools, what role can governments play? I think it comes down to three key areas which are improving the investment opportunity, reducing risk, and limiting uncertainty. So what does that look like from a policy perspective? This is my wish list from the financial institution perspective, explicit government-backed credit support for US-Japan LNG investment would reduce uncertainty and unlock capital. Specifically, this means guarantees first-law structures and other forms of credit support for Southeast Asian nations. Additionally, explicit frameworks for inbound US energy investment from its allies and venues for further US-Japan investment in Southeast Asia, especially around energy infrastructure.

The scaling of current efforts would provide for greater energy security in the region and in all of this clear, consistent policy communication is key to reducing uncertainty and unlocking investment. I’m going to come back to that point as well. Again, from the wish list perspective of a trader and a financial institution, governments can help absorb market risk. LNG contracts extend beyond the reach of transactable financial markets, which essentially means they cannot be fully hedged in the market and there is some long-term risk about the liability of price risk for LNG. So by governments recognizing the long-term nature of LNG contracts, which are required for financing, they can play a role in energy stability. So similar to credit risk guarantees, governments can step in and help mitigate market risk and market fluctuations. Again, this unlocks additional demand, including from financial institutions who with some sort of support would consider taking out their own LNG export contracts. So market risk absorption means more financing certainty means greater investment flows.

Additionally, this is talked about from an energy security perspective, investments in infrastructure and energy security can scale as well. Gas and LNG storage, of which Japan is a leader. When you think about LNG storage, some of the greatest stocks in Asia, and a very robust framework for maintaining those stocks driven by the government as well as cooperation in energy security, supply routes and shipbuilding, which is very important. All of these can grow, provide greater confidence to the market. Market participants have greater confidence, it reduces the risk of disruption, again, leads to greater investment flows, and all of these can be underpinned by various market and financing tools. When you think about a build out of storage and when you think about increased shipbuilding capability.

So I think the important thing that I will definitely focus on is underpinning all of this is regulatory stability and transparent risk communication. Clear communication by both governments on sustainability policies and trade policies is a top priority because financial institutions and project financiers thrive on predictability. It’s challenging for investors to navigate major policy shifts and governments need to provide transparent and coordinated communication to business leaders in both countries who need clear risk assessments for long-term investments.

This also ensures the best possible environment for long-term investments. I think a key point is if the private sector is materially mispricing conflict risk, governments need to provide more clarity and insight to the extent that they can share it. Additionally, while these goals that I’m talking about right now might be aligned with the current administrations, obviously the new energy secretary wants to unleash US energy. The administration is very focused on the trade deficit. That’s all great. Midterm elections happen, governments change. LNG contracts are generally 15 to 20 years. There needs to be some form of stability such that permits and LNG facilities believe that they’re able to operate and construct and be in a position to provide project finance type returns.

So in closing, when it comes to LNG and energy and US-Japan cooperation, none of this is about future technology. From my perspective, it’s about execution. The US and Japan have the expertise, they have the infrastructure, they have the capital. The private sector is ready. Governments have to reduce risk, increase uncertainty, and let investment flow. And for financial institutions to increase investment in energy and specifically LNG, they need stable regulatory frameworks to avoid political risk, government-backed risk-sharing mechanisms, whether it’s credit or market also can enhance creditworthiness of projects and help get them built and creating incentives for blended financing structures will bring in more private capital. All of this comes with the goal of facilitating long-term LNG contracts, scaling investment in Southeast Asia and its energy infrastructure and reducing supply chain and market risks. Thank you.

Kenneth R. Weinstein:

Well thank you very much. That was really a model of clarity and structure. Let me turn to you, Kenan, for a couple of questions. One, the US-Japan summit last week there was obviously a focus on the proposed Alaska LNG pipeline, something which we here at Hudson have championed in a paper that Will Chou and I put out on building out the free and open Indo-Pacific. The argument being US-Japan cooperation on the LNG pipeline will allow LNG to flow to Asia much more quickly, largely under the American security umbrella. Could provide LNG not just to Japan leading to much enhanced energy security, but also to South Korea and Taiwan and that Japan and South Korea in particular, given the kind of expertise you talked about, could become the downward spigots for the rest of Southeast Asia. How do you, in your personal capacity, not your J.P. Morgan capacity view this development? How realistic is it?

Kenan Arkan:

I actually have a colleague in the room who is an LNG project financier extraordinaire, so she should tell me very quickly if I’m going off script. I think it’s an interesting project.

Kenneth R. Weinstein:

Go back to your college, you can huddle for a second. Take signals.

Kenan Arkan:

I think it’s an interesting project in my career. I’ve had the good fortune of meeting with the Alaska government a number of times about this project. At times when we met the arbitrage window, when you just think about the price in the US versus the price in Japan was very firmly closed and so it was not economically viable from that perspective. But I think the summit talked about more than just the economics of it. It’s the energy security aspect and obviously you have very little shipping lane disruption possible between Alaska and Japan.

West Coast of North America, whether it’s Canada or the US, LNG has always made a lot of sense when you think about avoiding Cape route, avoiding Panama Canal, which has obviously been in the news more recently. I think the biggest challenge, and you’ve seen this with LNG Canada, which is west coast of Canada project and British Columbia terrain, it’s challenging. Alaska is further north than British Columbia. It’s challenging to build things there. The price tag is expensive. It’s $44 billion, which is a multiple of the US Gulf Coast projects.

But I think if the investment is there and there’s putting a market price if you will, on energy security and stability for having that, the resources there, it’s really just been a matter of the political ping-pong between administrations and whether or not they’re willing to allow for development in Alaska. I think it’s certainly an interesting project when you think about energy security and stability, but again, the economics of it can fluctuate over a long period of time, so someone has to bear that risk and understand that they’re making an investment in security and supply and not treating it like a trading position.

Kenneth R. Weinstein:

Okay, thank you. I’m going to now give the second the question I was going to ask you. I’m going to now turn to Shimazu-San and ask you this question. Kenan brought up the question of shipbuilding and we have seen in recent years allied shipbuilding capacity leave the US, leave Japan, even leave South Korea and head to China, which now dominates the global shipbuilding industry. How do you folks think at METI about the need to restore shipbuilding as a priority in order to get to this moment of energy transition and to promote the kind of security that we’re going to need in potential of a global. . . Obviously some kind of a Taiwan contingency or the like? Thank you.

Yuki Shimazu:

So I have to apologize because I have not prepared on that. I’m not an expert in the shipbuilding. I think it’s more like the ministry of transportation, but in general, the increasing the shipping, manufacturing, the ability is also important for our countries. But our ministry has energy agency, so it is focused on the LNG project itself. So I can’t say anything about that. Sorry.

Kenan Arkan:

I’m happy to talk a little bit about it. When we look at the forward order book for LNG carriers historically dominated by South Korea, obviously LNG ships are among the most technologically sophisticated of large bulk shipping types.

From what we’ve heard anecdotally from client conversations, China has stepped in, increased its investment, increased its competitiveness when you think about the cost of LNG tankers, and increased the manufacturing availability of it. South Korean shipbuilders and shipyards have been completely maxed out from what we’ve heard for a long period of time. So China has stepped in and now offered a competitive product, cheaper and availability to build it. And so clients have no choice but to essentially go where they can get ships built. And so that has been what’s driven it more than anything.

I do agree the US is a great operator. We have someone who’s the non-executive chairman of a large shipping company including LNG in the room and a great user of LNG ships and trader of LNG ships, but there is no manufacturing to speak of, which I think is a critical flaw when you think about times of conflict and being able to actually access necessary transport to get energy to where it needs to go.

Kenneth R. Weinstein:

Yeah, we recently did a workshop on NATO-IP4 cooperation here at Hudson and the notion of the need to work together with Japan, with the Europeans to step up our shipbuilding capacity was the basis for one of the papers, which in a report that’s going to be released soon. Shimazu, let me turn to you in another direction then on a question you can answer, which is because it is the bailiwick of your ministry. When you look at the potential investments, there’re obviously a number of Southeast Asian nations have significant LNG capacity themselves. And when you think about the potential investments, do you think about LNG investments in those countries and how do you think about them?

Yuki Shimazu:

Yeah, Philippines and Vietnam, I think. So as I presented, a lot of Southeast Asian countries will expect a strong growth, I mean economic growth from now. And another factor we need to think about is that they are using more LNG rather than coal from now and the future and then the two factors comes into the Philippines and Vietnam as the most promising countries. But the problem is uncertainty, as he said.

So when I went to Vietnam and the Philippines last summer, I had a lot of meetings with those people and I found that the market structure for a long-term contract is not really, I don’t say. . . It’s not perfect, so it’s not really confident, full confidence status. So we need to step in talking with those people and try to understand the domestic political power game and how to change those regulatory framework and market structure and the business environment. That’s going to be the key, I think.

Kenneth R. Weinstein:

Great, thank you. David, let me ask you, you heard Professor Jimbo’s presentation about the need for ASEAN autonomy and the need for ASEAN’s voice to be heard more loudly to cooperation with ASEAN. When you look at the defense question, do you see a contradiction between the need for economic engagement with ASEAN and the need for these kinds of defense partnerships? Is there a danger that ASEAN’s centrality in some sense, and I know that’s not the term you used, Professor Jimbo, that that will impinge on the kinds of defense cooperation that you’re calling for that are really needed in such a major way in the Indo-Pacific?

David Byrd:

I actually think they’re quite complementary. Something that I think we’ve come to appreciate is how this isn’t just the US comes with a plan and everybody just falls in line. That’s not a viable model for how that kind of cooperation can work. Each nation has its own very particular security needs and its own particular resource constraints that it has to deal with. And I think fundamental to this is the knowledge that the US can’t be everywhere at once and it can’t control these other nations. So it is really about empowering that level of autonomy so that these smaller nations can, from a security perspective, really punch above their weight. And so that makes them less attractive targets for coercion, it makes them more difficult to cow and bully out of any sort of cooperative agreement, and it provides the US more strategic and operational flexibility to come in if it is needed.

A metaphor that one of my colleagues uses is that traditionally we’ve been basically playing a goal line defense strategy. I’m sure a lot of football fans in here, but it’s basically you put all of your players right on the line and you say, “Not one inch forward, nobody gets past the line of scrimmage.” Well that works sometimes, but it’s very difficult to maintain and if it does collapse, it collapses dramatically. This new security paradigm is really about how do you build more strategic, I guess you could consider it defense in depth. And a lot of that involves empowering these nations that are forward placed, are near China, are at risk of these kinds of both these weapons and political coercion to resist those efforts and complicate PLA decision making. So I think they’re quite complementary.

Kenneth R. Weinstein:

Thank you. Let me then turn to Ken Jimbo for the last question before opening up to the audience. We’ve obviously seen this incredible increase in US-Japan cooperation in Southeast Asia that began with the US adoption of the free and open Indo-Pacific concept has increased now through the trilateral with the Philippines more broadly as strategic convergence both on the defense side and on the international development side. China, at the same time, though has adopted its own kind of China plus one strategy in terms of manufacturing where so many Chinese companies are now manufacturing in Vietnam in particular, moving industries to elsewhere in Southeast Asia in part to try to avoid tariffs, in part to embed China in the economic architecture of these countries. How does that complicate the strategy that you laid out?

Ken Jimbo:

Yeah, that’s a great point. I think that if you go to Southeast Asia, that great power competition has become the default and there are many layers that you can find the contested areas, but there’s also so much complementarity in a sense that ones that you provided, you are provided with digital infrastructure that the application can really co-write. I mean with the US Western application versus what the Chinese EC system and that can really can coordinate it with each other. So it’s a multiplex system that you can find in Southeast Asia.

But at the outset, I think what is important is that by having a more resilient economic and military structure that we see in Southeast Asia, they probably have the capacity to deny once that they are pressured to choose the size, especially by China. And once that they have become more confident in having those kinds of capability, they may have a multiple choices that they can provide even for us.

So once we try to provide the free and open Indo-Pacific strategy, and I was very encouraged to hear that President Trump mentioned about the peace and strength throughout the Indo-Pacific should be the key priorities for the US-Japan coordination. But at the same time, I think that the Japanese approaches have been quite nuanced in a way by looking at the new plan for Indo-Pacific strategy that the former Prime Minister Kishida has laid out, it’s much more like a bazaar type, a listing of the fifty-something types of the corporation without any ideological attachment is there.

But to let the Southeast Asia to pick and choose whatever they can really, I think contribute to their economic and political connectivity projects as such. As a result they can be part of our project. And this is something quite important in a way of the model of the defense is very interesting to see because sometimes that if you want to achieve the strategic goal, you don’t want to mention about strategy, you can actually create the default as a corporation and then you can actually choose what has been shaped by the accumulation of the pragmatic approach that we have.

Kenneth R. Weinstein:

We will not take offense here in Washington to the notion of a nuanced strategy, even if we are not always the great authors of that here in the United States. And the notion in Prime Minister Kishida’s concept also of a new term of Indo-Pacific centrality, particularly in dealing with crises as a way to sort of bridge to start to build up the kind of coordination that needs to occur. Natural disasters in particular was quite key to that. And it fits exactly as you say.

We have time for a couple of very brief questions. If you want to stand up, identify yourself and ask a question, not make a statement, that would be lovely. Great. Nadia Schadlow, a senior fellow here at Hudson. You don’t even have to identify yourself.

Nadia Schadlow:

Sorry, I have a question being not an expert at all on the issues, but is there a fundamental difference between how Japan and the United States view the infrastructure part of the LNG problem set? Is that an area on the infrastructure side? Because the points that the gentleman from J.P. Morgan made about underwriting risk, long-term contracts, the difficulties of getting the infrastructure side right, the trillion dollars in FDI. So is there a fundamental difference in how you see that infrastructure part of the equation and the tools that our countries have? Are there a different set of tools?

Kenan Arkan:

From a private sector perspective? I don’t think so because Japanese corporates have very substantial, well, we’ll call it substantial US LNG export contracts right now as well as Qatar and other providers of it, Russia being one. So I don’t think on the underpinning of exports. I can speak less to the downstream meaning imports into Philippines, Vietnam, et cetera. But the issue being a US corporation that’s building an LNG export facility needs to go and get a credit rating, project finance, and project financiers are only going to look at this and look at the credit rating and say, “What is the average credit quality of the people that are signed up for long-term LNG exports from you? What’s that average look like? And do we believe that this project is a sustainable series of cash flows?”

And so I don’t think there’s really been anything done yet from a supporting those nations. In 2022, I think the DFC got to the term sheet stage, but it was to underpin hedging by a European corporate that was trying to meet US foreign policy goals, which is essentially get off of Russian pipeline gas. But I have not heard of that happening yet. And so I think that is a disconnect that I personally, professionally would like to see solved.

Kenneth R. Weinstein:

Okay. Last question. Boy. Okay, hold on. Okay, false alarm back there. We almost had someone buy the Renoir for 38 million dollars, but not to be. . . Let me sort of wrap up by just generally asking if someone wants to answer how they see Southeast Asian nations governments responding to the current situation, the two new administrations. If you want to say something, maybe Ken on this, the US, the Trump administration, the Ishiba government, how they’re responding to the sort of new dynamics.

Ken Jimbo:

Well, I think the first two weeks of the Trump administration has been overwhelming. And every day I wake up in the morning with surprising news that coming from-

Kenneth R. Weinstein:

Not alone.

Ken Jimbo:

Washington DC and it’s great to find out that sense of normal practices in US-Japan relationship by reconfirming the every checkpoint that needs to be sorted out. And that really created lots of assurances to the rest of the region. For example, committing to the denuclearization of North Korea is one, and also the peace in security of the Taiwan Straits and commitment on that and committing to the free and open Indo-Pacific. And that really has been the ensuring processes that the US regional engagement is here to stay.

But at the same time, from the Southeast Asian perspective, there has been low expectation that the president spent time in Southeast Asia, which is important practices that the spending time in the East China, sorry, that East Asia Summit and the ASEAN plus meetings and also there has been concern about the fate of the APAF, which is the, I think at the most important institutional communication mechanism for the economic security policy. So those kinds of continuity and practices processes is the matter that they are now thinking about.

Kenneth R. Weinstein:

Okay. Well, thank you On that note, look, I should note the president also has had an excellent discussion with, we’re delighted to have the Philippines Deputy Chief of Mission here, and we had the president an excellent discussion with President Marcos that led also to, in part, to the reaffirmation of the US-Japan Philippine Trilateral, which is very welcome news here.

Let me just thank our panelists, Ken, David, Yuki, and Kenan for an excellent discussion. And I just want to thank everyone here for coming in on this snowy day to thank our audience at home, thank my colleague Will Chou and the Hudson Institute events team for all the hard work that went into today’s event. Thank you so much. Take care.

Major General Mark Mitchum will discuss the Air Force’s nascent Integrated Capabilities Command.

Join Hudson Institute for an event with Norwegian Finance Minister Jens Stoltenberg.

Join Hudson for a conversation between Indian Finance Secretary Ajay Seth and Distinguished Fellow Walter Russell Mead.

Hudson Institute’s Center on Europe and Eurasia will host its third Central and Eastern Europe (CEE) Strategy Summit.